Discovery chemistry outsourcing

Posted: 26 April 2012 |

In 2002, Novartis decided to create a new research centre in Cambridge, MA. This was accompanied by a significant increase in headcount in medicinal chemistry. Within two years, this resulted in a strongly increased demand for prep-scale synthesis which in turn led to priority issues and to prolonged turnaround times due to lack of resources in our Preparations Laboratories. In order to debottleneck time critical scale-up activities, the Preparations Laboratories was asked in 2004 to introduce outsourcing as an alternative option to an in-house increase of headcount…

In 2002, Novartis decided to create a new research centre in Cambridge, MA. This was accompanied by a significant increase in headcount in medicinal chemistry. Within two years, this resulted in a strongly increased demand for prep-scale synthesis which in turn led to priority issues and to prolonged turnaround times due to lack of resources in our Preparations Laboratories. In order to debottleneck time critical scale-up activities, the Preparations Laboratories was asked in 2004 to introduce outsourcing as an alternative option to an in-house increase of headcount.

Regarding the selection for outsourcing of projects, the following selection criteria should apply:

- ‘Easy’ projects with a good chance of success, i.e. well documented and few process steps

- Shorter time for critical requests

- Non-critical projects with regard to proprietary situation, giving us better control of quality and protection of know-how

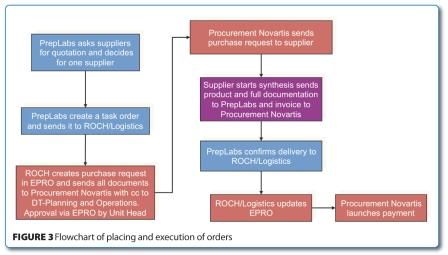

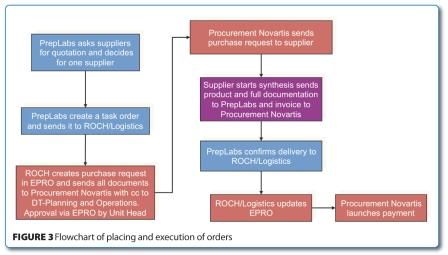

In order to differentiate the individual com – panies from each other, the evaluation criteria outlined below were applied:

- Response time, i.e. how fast did we get the quotation?

- Costs per process step l Lead time: delivery date as agreed?

- Quality: did the quality meet our expectations?

- Quantity: target amount delivered?

- Flexibility in case of issues, e.g. short time changes, troubleshooting, etc.

- Collaboration, i.e. are the employees at their level competent in what they are doing, how is their availability, do they report well and properly and are they reliable?

Evaluation of outsourcing companies After choosing the selection and evaluation criteria, the evaluation process began. For this purpose, we invited outsourcing companies of interest to us. Finally, nine companies were selected according to the following profiles:

- The geographic regions. Here the aim was to have these companies located in different countries because of strategic reasons

- The reactor size, and often associated with that …

- … the company size

- The know-how / expertise and available technologies

With respect to the latter item, it was, for example, of special interest to know if the company had the know-how to prepare betaamino acids or to have access to ozonolysis methodology or up-to-date purification facilities and capabilities.

The evaluation strategy consisted of quotes from each company for at least four projects. Each project was to be quoted by at least two companies, and that company would perform at least two projects.

The results of the evaluation are shown in Figure 1.

As outlined, the evaluated companies were distributed over the three continents of Asia, America and Europe. It should be stressed that costs per process step was not the one and only evaluation parameter. We also took into consideration the discovery phase which was an even more important criterion to rate the individual companies. An interesting result worth mentioning was that the US based company was as competitive as Indian based companies. This also applied to the company from Slovakia. The other European based companies were in a price range of 6-9 KCHF per process step.

Selecting the preferred partners

After thorough analysis of the evaluation criteria including individual experiences made with the various companies during the project executions, the companies were selected to collaborate with as preferred external suppliers (see below).

With the exception of Company 4, all other companies exhibited high flexibility, a characteristic which is of utmost importance in the drug discovery phase. It also turned out that this company was not suitable for performing less complicated projects. However, this was the company to choose for placing more complex, larger scale requests because they had low prices and a good collaboration was experienced during the evaluation phase.

Another company that was chosen despite the fact that it had some weaknesses was Company 1, located in Switzerland. It had high average costs per process step, however this was compensated by the fact that the company was in close proximity to the location, thus enabling us to place high priority projects. In addition, the close vicinity allowed for ad hoc face to face meetings and discussions in case of troubleshooting etc.

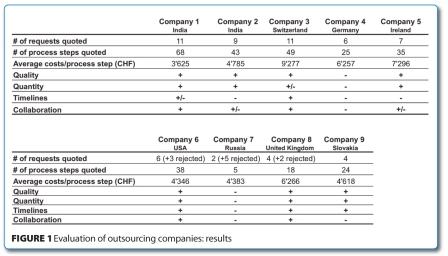

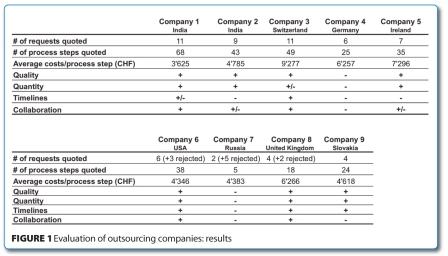

Implementation of internal processes

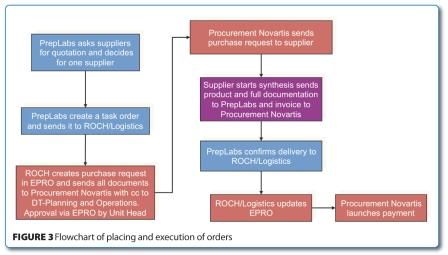

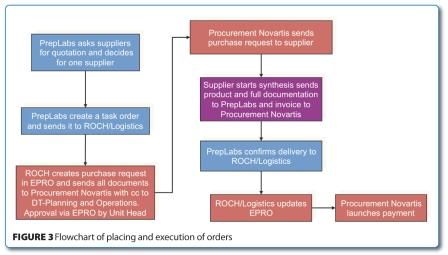

In parallel to these more external related activities, internal ones also had to be executed in order to establish and speed-up the in-house processes required for a fast outsourcing. Meetings with the legal department were organised to set-up a master service and supply agreement which was finally signed by both parties. With the help and support of our finance group, a dedicated cost centre for the outsourcing activities was created. It enabled control over the budget at any time. Last but not least, an efficient workflow was established to streamline the internal process for ordering and administration. The flow chart outlined in Figure 3 exemplifies the internal process for placing and executing task orders.

Conclusion and outlook

To summarise, five companies were identified with whom collaborations were entered. The implementation of an internal workflow to speed-up the ordering process was very helpful and extremely beneficial.

Following a reflection of author’s own experiences, there is a feeling that the workload associated with outsourcing is being underestimated. Asking for quotations and placing the order is not the one and only activity to be carried out, especially in the drug discovery phase. Issues always arise and at any stage of the request, be it in terms of the synthesis or during the purification or any other non-chemistry related issue. They have to be discussed and to be solved. Therefore, it is very, very important to keep close contact with the individual preferred external suppliers. This paves the way to mutual trust and an excellent collaboration. Whenever possible, the preferred external suppliers should be visited. Experiences have shown that this creates, in addition to mutual trust, mutual respect and appreciation.

The evaluation of external partners is and will always be a continuous process. At the very beginning of the evaluation, nobody realised how much effort it would take to establish this business from scratch. Now there is gratifying satisfaction to have this business in place, not only because outsourcing enables us to have high flexibility, but also because this business has become an integral part of the Preparations Laboratories activities expanding the lab heads activity beyond his/her own lab and communicating with the world. This brings, as well as an additional workload, a lot of satisfaction.

Acknowledgement

The author would like to thank all colleagues involved in this evaluation. Special thanks go to Constanze Hartwieg, Hansjoerg Lehmann and Thomas Leutert for their huge efforts and dedication to this evaluation which otherwise it would not have been possible.

About the author

Luigi La Vecchia carried out his PhD 1989 at the University of Saarbruecken, Germany. Currently, he is Head of the Preparations Laboratories of the Novartis Institute of Biomedical Sciences where the outsourcing of building blocks and other chemical matters is an integral part of the business.