Forecasting in dynamic Oncology Markets

Posted: 14 March 2016 | | No comments yet

Two big things struck me as interesting during an Innovations in Oncology Conference in Edinburgh this month…

Two big things struck me as interesting during an Innovations in Oncology Conference in Edinburgh this month. Firstly how exciting the market is right now, with many productive collaborations between academia, biotech’s, big pharma and charities being discussed.

Secondly how challenging it will be for health systems to respond to such rapid change, particularly to the emerging trends in immuno-oncology. Then it dawned on me, as treatment regimes evolve and new molecules start being used in combination with existing treatments, the analysis of Oncology Markets will be particularly challenging in the future.

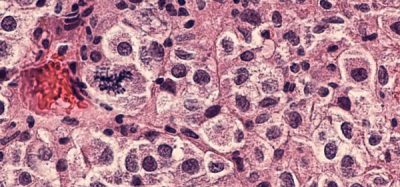

Industry commentators believe immuno-oncology to be the third major breakthrough in cancer treatment, following the early days of chemotherapy and the targeted treatments that followed on from them. Immuno-oncology seeks to address cancers’ ability to evolve resistance by boosting the bodies own defence systems in combating tumours over a range of different stages. However immuno-oncology is not intended to be used in a silo to existing technologies, it is no panacea. Only by combining with traditional approaches, (including chemotherapy, targeted treatment and surgery), will approaches that help the body muster it’s one defence mechanisms cause tipping points within progression pathways. Thus, by both decreasing the likelihood of mutations and metastases from occurring whilst simultaneously minimising their impact when they do, it is hoped that many cancers become chronic illnesses – similar to how triple combination therapy in HIV has helped people live near normal life spans after contracting the virus.

There are analogies with this adaptive approach, selecting from a portfolio of treatment options, to the ways in which Black Swan Analysis now approaches forecasting within dynamic markets. When any new field starts to blossom it is important to step back and take a 360 degree view. Analysing from a variety of angles both the potential disruptors as well as the ways in which our existing epidemiological models are still useful in helping predict future trends.

We have recently completed several multi-market valuations and dynamic models for specific oncology diseases using our OncoStrat™ platform. Though currently in Excel, later this year we will moving into the cloud to enable sharing of the information between the different company affiliates. We feel this will be important for a market place that is seeing such a large amount of collaborative working and evolving at an unprecedented pace.

Another tool we have recently developed for our clients is the Market Impact Tool that allows scenario planning and a degree of predictive analytics in market places that could be disrupted by new product entries as well as generics and bio-similars. Here we also utilise market research to help us calibrate the impact of such events because as well as identifying the opportunity, the risks in the market also need to be highlighted. These can take the form of a competitor, whether direct or indirect competition, adjacent technology as well as upstream changes to the treatment or diagnostic pathway. Thus contingency planning can be instigated to help manage inherent risk to a degree that doesn’t jeopardise the eventual return on investment.

No model is perfect. However by making them dynamically reactive to market changes we hope their usefulness will continue to evolve and help overcome new challenges. As Nassim Nicolas Taleb states, a black swan event depends on the observer. For example, what may be a black swan surprise for a turkey is not a black swan surprise to its butcher. Hence the objective should be to avoid being the turkey, identifying areas of vulnerability in order to turn the Black Swans white.