GSK tops list ranking big pharma’s global access to medicine

Posted: 14 November 2016 | | No comments yet

Read how the 2016 Access to Medicine Index ranks the top 20 pharmaceutical companies on their efforts to improve access to medicine in low- and middle-income countries…

The efforts of pharmaceutical companies to get their products to those who need it most, the vulnerable and the poor, and to address many global health priorities are getting more sophisticated. However, good practice is limited to a narrow range of products and countries and opportunities to expand such targeting of efforts are yet to be realised.

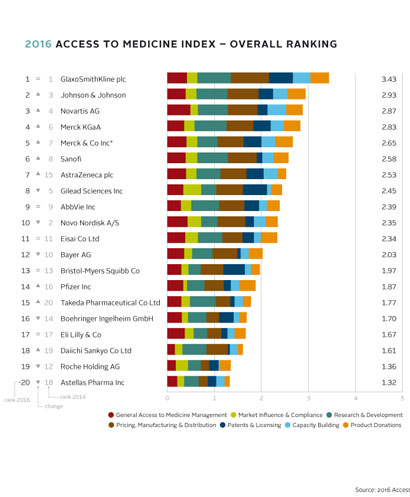

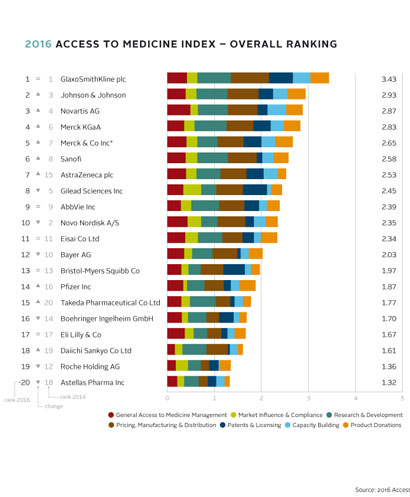

The 2016 Access to Medicine Index ranks the top 20 pharmaceutical companies on their efforts to improve access to medicine in low- and middle-income countries. It found that GSK, which leads the Index for the fifth time, performs best when it comes to matching its access activities with particular needs within the access to medicine agenda.

GSK is joined at the top of the Index by a closely packed group comprising Johnson & Johnson, Novartis and Merck. The pharmaceutical industry is extremely diverse, and this is reflected in the way each company approaches access to medicine. However, the four companies in this leadership group share some distinguishing characteristics. They have the most mature access programmes, with well-organised access strategies that support business development in emerging markets, where the need for access to medicine is high. They also show the most evidence of addressing independently identified high-priority needs.

GSK, J&J and Novartis top the access to medicine index

“We see evidence that collaborative R&D models are engaging the industry in developing urgently needed medicines they would not otherwise be considering because there is not enough of a commercial market for them,” said Jayasree Iyer, Executive Director of the Access to Medicine Foundation. “The partnership approach is working.”

The 2016 Index has assessed the extent to which a company’s access operations are needs-oriented: where actions match specific priorities identified by, for instance, countries, the global health community or the Index. In this regard, the Index analysis reveals uneven performance.

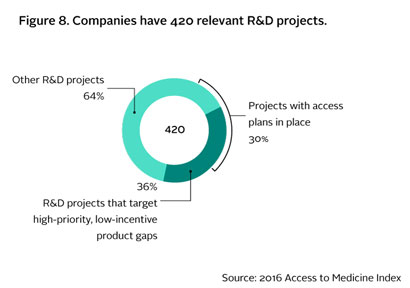

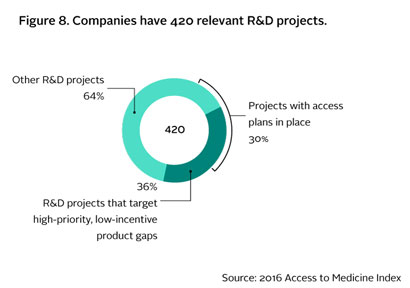

The companies have 850 products on the market for the 51 most burdensome diseases in low- and middle-income countries, and are developing another 420. This includes more than 100 products that have entered the pipeline since 2014 and 151 with low commercial incentive but which are urgently needed, mainly by the poor.

The majority, 67%, of the research projects that companies have for high-priority, low-incentive products are being conducted in partnerships, the Index finds.

Progress in making more medicines more available is also seen in the way companies are handling their patents and in the extent to which they are allowing other manufacturers to make generic versions of their products.

Since 2014, seven companies have published new or expanded pledges to waive or abandon patent rights for certain products in certain regions. More HIV/AIDS products are covered by voluntary licenses and these apply in more countries than they did before. And for the first time, they are being used to expand access to medicines for a disease other than HIV/AIDS – hepatitis C. Globally, between 130–150 million people have chronic hepatitis C infection.

“We have been assessing these 20 companies for 10 years now. We know what works, where. There is good practice and where there are mechanisms to incentivise industry engagement, such as patent pooling, collaborative R&D models, multi-stakeholder initiatives and international commitments to certain diseases, we see the industry responding,” Iyer said.

However, a product can only be made available in a country once it has been registered there. The Index finds that, for their newest products, companies apply for registration in only 25% of countries the Index identifies as the highest priority.

Making products more affordable is another cornerstone of increasing access to medicine.

The Index finds that pricing schemes that take account of the ability to pay are being applied to one-third of relevant products. This has not changed since the last Index two years ago. Only 5% of products (44 out of 850) have such pricing strategies applied in countries the Index identifies as the highest-priority, with at least one socio-economic factor being taken into account. Around half of these products are from GSK and AstraZeneca.

Other findings include:

- A quarter of companies (5) are piloting new business models that aim to reach low-income populations.

- The diseases getting the most attention from company access activities are heart disease, lower respiratory infections and HIV/AIDS. R&D is still concentrated on five diseases, with lower respiratory infections getting the most focus, followed by diabetes, malaria, viral hepatitis and HIV/AIDS.

- Most companies are working to strengthen healthcare systems in low- and middle-income countries. Six consistently match these activities to priorities identified by local parties, including governments.

The companies that rose most significantly up the Index were AstraZeneca and Takeda, which both extensively expanded and updated their access strategies. AstraZeneca climbed eight positions into the top 10 to take 7th position, while Takeda moved up five places to rank 15th.

Meanwhile, Novo Nordisk, Roche and Gilead have experienced the most significant drops in ranking, after being outperformed by peers.

“Access to medicine is a collective responsibility –from the industry to governments and the global health community– they need to challenge themselves to support the ramping up of these efforts to ensure they are expanded to more products in more countries so that pharmaceutical products reach the people who need them.”

Related organisations

AstraZeneca, Gilead Sciences, GlaxoSmithKline (GSK), Johnson & Johnson, Merck, Novartis, Novo Nordisk, Roche, Takeda Pharmaceutical Company Limited