Novartis nets potential first-in-class medicine in new cardiovascular acquisition

Posted: 11 February 2025 | Catherine Eckford (European Pharmaceutical Review) | 1 comment

The potentially multi-billion-dollar deal strengths Novartis’ late-stage pipeline for cardiovascular therapies, signalling advancement of novel treatments for heart disease.

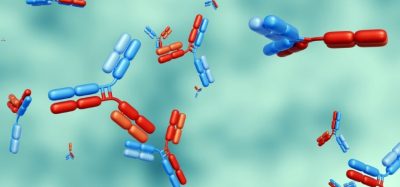

Novartis has agreed to acquire Anthos Therapeutics, Inc., and will gain rights to a potential first-in-class biologic. Anthos has been developing the monoclonal antibody abelacimab as a treatment to prevent stroke and systemic embolism in individuals with atrial fibrillation, under a license from Novartis.

The therapy is designed to induce effective haemostasis-sparing anticoagulation through Factor XI inhibition, preventing the activated form (Factor XIa) being generated. This mimics natural Factor XI deficiency, which is associated with protection from thromboembolic disease, according to Novartis.

Under the agreement, Novartis will pay $925 million upfront. Potential additional payments of up to $2.15 billion are also available, subject to achievement of certain sales and regulatory milestones.

Clinical data on the monoclonal antibody

Phase II data evaluating the monoclonal antibody in atrial fibrillation found that the treatment significant reduced bleeding events compared to a standard of care direct-oral anticoagulant. This is based on investigation of the AZALEA study.

Additionally, three ongoing Phase III clinical trials are assessing the monoclonal antibody in patients at risk of arterial and venous clots, one in patients with atrial fibrillation (LILAC-TIMI 76) and two in cancer associated thrombosis (ASTER) and (MAGNOLIA), Novartis added.

Advancing current standards of care in thrombosis and stroke

“Abelacimab is a potential first-in-class medicine, which promises to be an effective and safer approach to preventing thrombosis and stroke than the current standards of care”

“Abelacimab is a potential first-in-class medicine, which promises to be an effective and safer approach to preventing thrombosis and stroke than the current standards of care,” stated Dr David Soergel, Global Head, Cardiovascular, Renal and Metabolism Development Unit, Novartis.

“Welcoming Anthos Therapeutics strengthens our focus in the cardiovascular space and complements our… strategic collaborations that help thousands of patients with heart disease around the world,” remarked Dr Shreeram Aradhye, President, Development and Chief Medical Officer, Novartis.

The transaction, set to advance development of the monoclonal antibody, is anticipated to close in the first half of 2025, subject to customary closing conditions.

This news follows Novartis announcement of a global license and collaboration agreement with PTC Therapeutics in December 2024, a deal valued up to a potential $1.9 billion. The transaction involves development of a potential first-in-class therapy to treat Huntington’s disease.

Related topics

Biologics, Biopharmaceuticals, Drug Development, Industry Insight, Mergers & Acquisitions, Research & Development (R&D), Therapeutics

This acquisition by Novartis is exciting! The potential for a first-in-class biologic in cardiovascular treatment could really change the game for patients. Looking forward to seeing how this develops!