Majority of CMO-acquired dose manufacturing facilities in Europe, report says

Posted: 5 October 2020 | Victoria Rees (European Pharmaceutical Review) | No comments yet

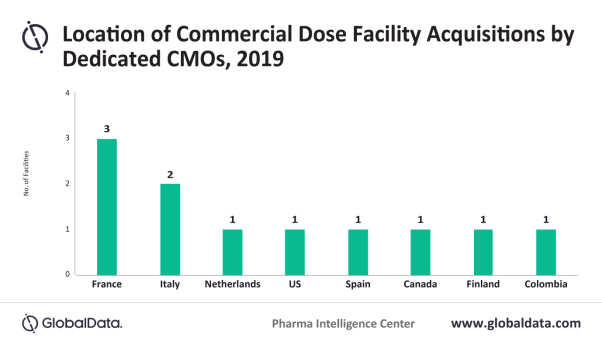

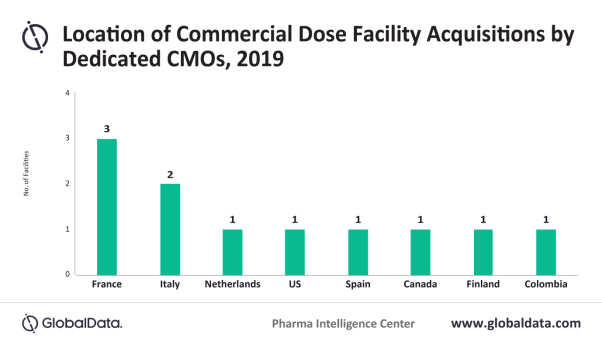

A new report has found that three quarters of dose manufacturing facilities acquired by dedicated CMOs in 2019 were in Europe.

According to a new report, three-fourths of dose manufacturing facilities acquired by dedicated contract manufacturing organisations (CMOs) in 2019 were located in Europe. The analysis was conducted on sites supplying the US, Canada, Europe or Japan.

Adam Bradbury, Pharma Analyst at GlobalData, which conducted the research, commented: “While European commercial dose facilities have been popular acquisitions for some time, the recent volume of deals is unusual. In 2019, 11 European dose manufacturing facilities were sold, which is roughly double the usual annual number. French and Italian manufacturing facilities accounted for almost half of acquired dose sites worldwide in 2019.”

The report highlights that the unusually large number of sales was precipitated by Famar’s parent company, the Marinopoulos Group, running into financial problems in previous years and completing a $198 million debt restructuring. Many of the facilities sold by Famar were solid dose manufacturing sites, perhaps because solid dose has become commoditized and is far less profitable than other dosage forms, such as injectables.

Bradbury concluded: “It remains to be seen whether the trend for acquiring European facilities will continue given the complexity and costs of running a site while following COVID-19-related regulations in the region. A total of 77 percent of marketed drugs have a solid dose form and 97 percent of marketed drugs are small molecules.”

Related topics

Contract Manufacturing, Dosage, Drug Manufacturing, Manufacturing, Mergers & Acquisitions, Outsourcing, Production