More than just cost cutting

Posted: 22 August 2005 | | No comments yet

In today’s challenging environment, aggressive cost control has become a common theme in the pharmaceutical industry.

In today’s challenging environment, aggressive cost control has become a common theme in the pharmaceutical industry.

In today’s challenging environment, aggressive cost control has become a common theme in the pharmaceutical industry.

It became fashionable later than in most industries, but today it is with us and it is here to stay:

- For the traditional pharmacos, the generics are putting a lid on the revenues from older products. For the generic manufacturers, low cost is a way of life.

- Many social security systems, which generate a large part of the revenues of the industry, are facing challenges because they are insufficiently funded and their ageing members have increasing needs.

- Emerging nations represent a growth opportunity but cannot afford expensive medications.

- Last but not least, research from discovery to clinical trials is increasingly expensive, while the payback period decreases.

Before cost pressures forced the implementation of a new Procurement organisation, the original function was predominantly structured to administer Purchase Orders and perform basic quotation requests. We then implemented the tools and culture previously found in other industries such as consumer products or assembly. By consolidating volume across plants and harmonising specifications, Procurement forced suppliers to improve terms. Often, consultants sped up the process and built organisational skills, initially resulting in double digit cost reduction, followed by smaller annual improvements. Negotiation skills were creating value by lowering the cost of the Bill of Material. Although this is far from best practice today, it marks the realisation by upper management that the Procurement function had more to contribute than merely offering transactional administrative support.

Profit margin improved for a few years, fuelling investment in better systems and attracting a new breed of good managers. They introduced a more strategic vision of the entire supply chain, gained insights on the Total Cost of Ownership (TCO) and redistributed responsibilities to reduce the TCO with cross-functional initiatives. E-Procurement solutions provided an additional transaction cost reduction. The most powerful companies sometimes convinced their suppliers to open their books, discuss their cost structure and offer new ideas to optimise interfaces, setup and management costs. Reaching this level required that firms rethink their organisation and their staffing approach. Those changes could only be justified with a long term vision of the Procurement function and its relation with the other functions in the firm. Nimbleness, flexibility, a culture open to change – those were the common traits of the new winners. The changes were therefore of strategic nature, to capture advantages through excellence in execution. Another change occurred. Procurement extended its responsibilities to support maintenance then capital investments. The support functions were also taking the opportunity to leverage Procurement in order to improve control of their budget. Today, most pharmaceutical companies have a professional procurement team dedicated to reducing the cost of services, from office supplies to marketing spend such as events and research. But is this new culture of Procurement sufficient? Where will it lead us? Other industries such as automotive or electronics have trodden this path before us, but relentless cost cutting did not save GM from the brink of bankruptcy, did not prevent Compaq from being acquired by HP and was not sufficient to satisfy HP’s shareholders after the merger. So what is missing? Can Procurement deliver more? How should CEOs view their Procurement and what should be their objectives?

From cost cutting to strategic supplier management

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage”, Warren Buffett, Fortune, November 1999.

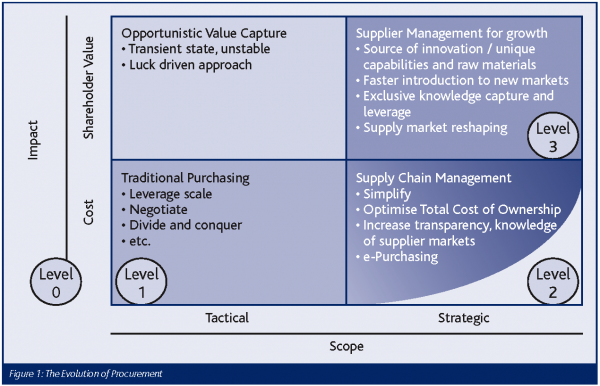

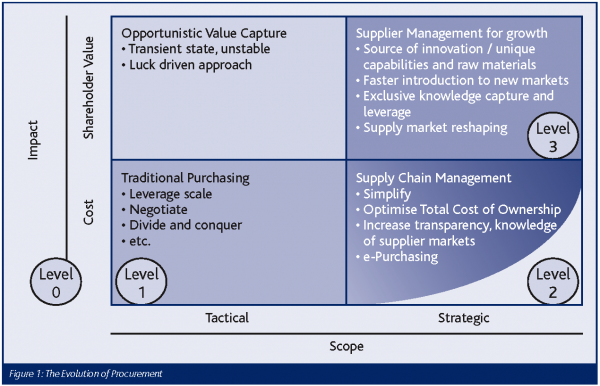

The Pharmaceutical industry today is under particular pressure to increase shareholder value. This must become an objective for all the functions of the firm, including Procurement, which in turn must reassess its role and its culture. But how many Procurement Professionals in our industry have asked themselves “What am I doing better than my competitors?” To contribute to the success of the firm on par with the other functions, the Procurement team must focus on identifying and capturing strategic advantages, impacting revenues in addition to profit. When Procurement is capable of having that much impact on the future of the Firm, it deserves to be on the CEO and the Shareholder’s agenda. The evolution of Procurement is illustrated by Figure 1.

When Procurement became an agent of change in a cross-functional approach to optimising the Total Cost of Ownership, its impact was transactional effectiveness (defined as ’level 2′ above). It improved the relationship between suppliers and the value chain of the firm, working together to solve problems more efficiently: design, logistics, value engineering, etc. were discussed. But this approach is not intrinsically differentiating because it has been discussed at length and implemented by many enterprises. Nothing in this approach is proprietary, unique, or differentiating. Firms that have not adopted a level 2 in procurement are lagging, but reaching level 2 is not a guarantee of being ahead for a significant time. The complexity of relationships in our industry has increased significantly. Innovative molecules and solutions are not systematically developed in house and then manufactured in integrated plants starting with basic raw materials. We leverage a network of biotech firms and academic research institutes for some part of our innovation. We outsource to low-cost Far-East facilities the production of bulk chemicals and to nimble secondary manufacturing specialists the packaging of our products. We rely increasingly on CROs to support clinical research and farm out data management to India or South Africa. Health economists and other key experts provide advice and support to our commercial departments. So in our innovation-driven environment, external resources have become increasingly important to value creation. But an innovation that is equally accessible to all players in an industry only builds value to the final users. Therefore it is important to manage the sources of innovation to build an extended enterprise rather than a loose relationship that will change direction or be broken with the winds of commercial relationships. Today, the Procurement leadership must develop key suppliers to quickly exploit their skills to their advantage, rather than for the benefit of the industry. It must contribute to shaping supplier’s strategies to speed entry into new markets. To do so, it must dedicate resources to facilitate seamless and exclusive transfer of value from the suppliers’ development labs to the final consumers and back. That is the reason why Procurement must understand the lifecycle value creation potential of an item, not only as a driver of the Total Cost of Ownership but, more importantly, as a driver of product pricing through the premiums provided by exclusivity and/or market growth for the company. Those types of initiatives can only succeed if both partners have common goals and the trust that both will work together rather than exploit a weakness of their associate at the first opportunity. It does not mean that cost cutting strategies are obsolete. They have become necessary rather than sufficient. They will be useful to manage a large portion of the addressable spend, not the entire spend.

This strategic sourcing approach, called ’Collaborative Sourcing‘, is differentiated from transactional effectiveness. It can deliver superior returns because it aims specifically at creating a gap between the firm and its direct competitors to create sustainable competitive advantages. Another impact is the securing of long-term strategic materials and resources. Transactional effectiveness only aims at improving the operational aspects of the relation, not to build value for the extended enterprise in a competitive environment. Transactional effectiveness is often driven by a buyer at level 2 who imposes its working approach on all suppliers, who in turn are forced to accede or be replaced by more compliant alternatives. It can also be the result of an industry wide effort, often pushed by solution vendors. Collaborative Sourcing requires a radical change in the culture and the vision of the relationship between buyer and supplier. Collaborative Sourcing can involve more than two companies, such as a supplier of raw materials, a packaging manufacturer and a final user. Therefore it is clear that Collaborative Sourcing goes beyond the performance of similar activities better than one’s rivals. It is a deliberate attempt to reposition the company by using different and distinctive approaches to managing suppliers. Few companies have competed successfully on the basis of better effectiveness for an extended period. Collaborative Sourcing is the strategic repositioning of the supplier relationship management. Collaborative Sourcing experts define, search, capture, isolate, manage and improve resources internal and external to the firm to deliver strategic advantages by optimising internal and external working relations. Collaborative Sourcing relies on trust between involved parties.

Comprehensive external resource management

Moreover, leveraging innovation requires the input of many functions in the firm. Therefore a sourcing strategy aimed at value capture relies heavily on collaborations within the firm. Building and managing this collaboration is a complex task that can only be effective if it is properly orchestrated: this is the role of the Sourcing Manager in the Procurement team.

So Collaborative Sourcing is not only a change in the relationship between the Enterprise and its suppliers. It is also a change in the relationship of the Sourcing Managers and the other functions. In the past, Procurement was only involved when the products hit the supply chain, usually at the industrialisation phase or later. Unfortunately, this approach presented several weaknesses:

- The scientists are often focusing on obtaining products or services to solve a development problem, rather than a supply chain issue. Therefore, they may not account for all the parameters involved in long term value creation.

- Although some scientists combine brilliant research capabilities with business savvy, many have less inclination for negotiation, long term cost benefit analysis, or similar skills that a modern Procurement professional has to master.

- Good scientists are in short supply, so why ask them to stretch themselves to cover tasks that others can do faster and more naturally?

To support Research activities, Procurement must be involved in securing sufficient supply of a difficult to find molecule. While the current needs may be for a few hundred grams of laboratory grade product, the long term growth of the company may require a thousand fold increase or more, with radically more complex specifications and service requirements, capable of entering into a GMP production environment, satisfying strict regulatory constrains.

Another area for Procurement involvement is the Clinical Research. Here we are not speaking of the mere improvement of contracts with CROs or academia. Today’s Procurement best practices will support a much more strategic and fruitful collaboration through the application of all the tools of the trade: the transparency tools such as cost modelling, the specification tools like benchmarking and process reengineering, in addition to the traditional negotiation tools.

Procurement must be a natural partner to all the functions in the Enterprise. Nobody but the finance team identifies and secures funding for a new research or a marketing initiative. Human resource professionals manage compensation and recruitment. The IT department develop and maintain the architecture of systems supporting all other functions. Likewise, if it is an external resource, it must be managed by the specialists in the Procurement Department.

To be effective contributors to the strategic issues of the Enterprise, the Procurement leadership must work closely with the other senior executives in charge of key functions. This can be done through an ad-hoc steering committee, usually with the Finance, Production, R&D and HR leaders. Increasingly, the executive in charge of Procurement reports directly to the CEO and sits on the executive leadership council. In this case, this executive is usually a Chief Procurement Officer, a CPO.

The role of the CPO is to optimise all the relations with external suppliers, a much broader role than the traditional cost cutting approach. It complements the transactional activities in the supplier relationship with Sourcing defined as “The process of identifying opportunities, evaluating potential sources, negotiating contracts and continuously managing supplier relationships to achieve corporate goals”, Pierre Mitchell, AMR Research.

Conclusion

In a world class Procurement organisation, the potential for creation of shareholder value, not merely the preservation of it, is an intrinsic part of the role. The function must be a contributor to strategic differentiation: not only being excellent in executing transactions but also identifying where it can contribute to develop sustainable competitive advantages. Obviously, there will always be a sizeable part of the portfolio that is spent on suppliers that bring no opportunity to differentiate. Those will be managed traditionally to reduce total cost of ownership. Industry-wide solutions, processes to improve transactional efficiency, will be used to stay at the front of the race. And for select relations, collaborative relationships will be developed to build value and support growth.