CROs as a strategic fit – the one stop shop for R&D services

Posted: 7 April 2008 | V. Sriram, Research Analyst, Frost and Sullivan | No comments yet

Contract Research Organisations (CROs) provide independent development services for pharma, biotechnology, and medical device markets. Services offered by CROs have evolved from providing basic support, to a wide range of services catering to various needs of the market and the sponsors. The United States is the world’s largest market for drugs and accounts for almost half of the research and development (R&D) spending in pharmaceutical and biotechnology markets. Hence, CROs have a strong presence in this market and have invested in new facilities and technologies to cater to a wide range of sponsors. It is estimated that only 25 percent of the R&D activity is currently being outsourced to these organisations. This is likely to double in the coming years due to mounting pressure on the pharmaceutical companies to increase productivity of the cost intensive drug development process.

Contract Research Organisations (CROs) provide independent development services for pharma, biotechnology, and medical device markets. Services offered by CROs have evolved from providing basic support, to a wide range of services catering to various needs of the market and the sponsors. The United States is the world’s largest market for drugs and accounts for almost half of the research and development (R&D) spending in pharmaceutical and biotechnology markets. Hence, CROs have a strong presence in this market and have invested in new facilities and technologies to cater to a wide range of sponsors. It is estimated that only 25 percent of the R&D activity is currently being outsourced to these organisations. This is likely to double in the coming years due to mounting pressure on the pharmaceutical companies to increase productivity of the cost intensive drug development process.

Contract Research Organisations (CROs) provide independent development services for pharma, biotechnology, and medical device markets. Services offered by CROs have evolved from providing basic support, to a wide range of services catering to various needs of the market and the sponsors. The United States is the world’s largest market for drugs and accounts for almost half of the research and development (R&D) spending in pharmaceutical and biotechnology markets. Hence, CROs have a strong presence in this market and have invested in new facilities and technologies to cater to a wide range of sponsors. It is estimated that only 25 percent of the R&D activity is currently being outsourced to these organisations. This is likely to double in the coming years due to mounting pressure on the pharmaceutical companies to increase productivity of the cost intensive drug development process.

In recent years, the portfolio of services offered by CROs has widened dramatically, with many CROs becoming a one stop shop (full service providers) offering an exhaustive list of core and ancillary R&D services. A majority of these overlap on pharmaceutical R&D enabling technologies, using proprietary techniques which include; genomics and proteomics, high throughput screening, combinatorial chemistry and many others. With the high level of merger and acquisition activity in the pharmaceutical industry and with larger companies using greater ‘downsizing’ strategies to concentrate resources on their core competencies, CROs are having to add extra capabilities to their menu of service offerings as a route to sustaining revenue growth. This broadening of CRO services is also leading to an increased availability of expert personnel. With a wider portfolio of services, many CROs now regard themselves as strategic partners of pharmaceutical clients rather than simple service providers or vendors. However, a large proportion of companies continue to view these contractors as specialists in discrete and niche areas.

Biopharmaceutical companies are beginning to turn their focus away from these larger, fullservice providers and are looking at more flexible organisations that can deliver proactive and innovative clinical development and life cycle management solutions on a global basis. As a result, medium-sized global CROs providing access to specialised expertise and expanded patient populations are experiencing significant growth and capturing an increasing market share. There is a definitive increase in the need for CROs to specialise in niche service areas, in addition to the ability and capability of managing complete drug development requirements.

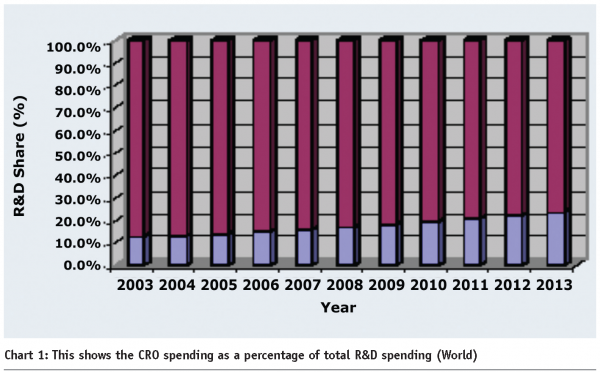

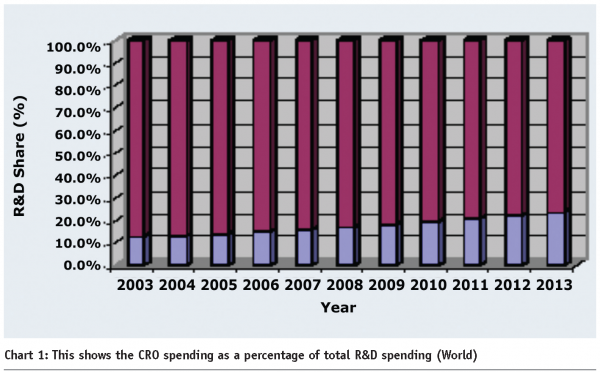

As pharmaceutical and biotechnology companies strive to improve their competitiveness, they are taking a long hard look at their outsourcing strategies. Many companies are seeking to reduce the number of global CROs with which they place contracts. They are looking for closer relationships with a smaller number of CROs that have world-class capabilities, competitive pricing and business processes that are compatible with their needs. At the same time, many companies are seeking to outsource a wider range of R&D tasks to CROs both on-shore and off-shore, as a way of reducing fixed operating costs (see Chart 1).

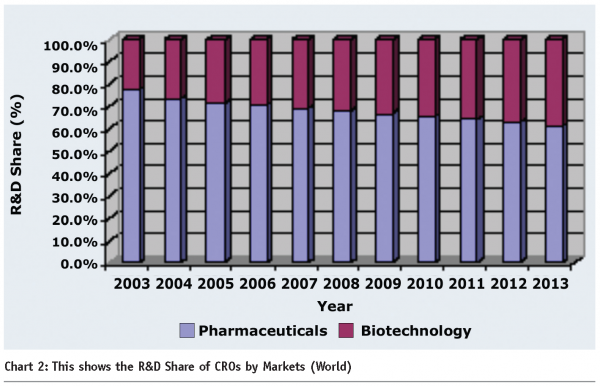

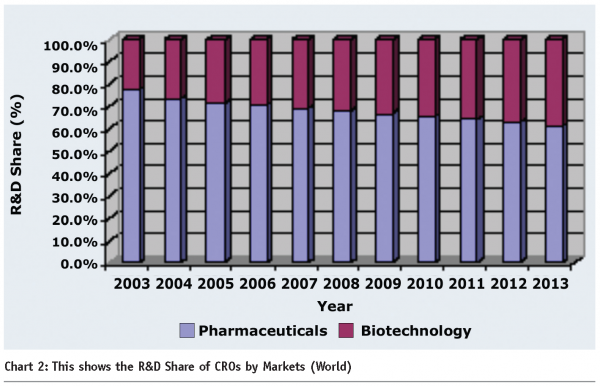

The importance of a strategic partnership is imperative as is evident from the spending as part of total R&D expenditure. The increasing contribution of CRO spending is bound to continue and reach as high as 30 percent by 2013 (see Chart 2).

Given the splurge in the growth of the biotechnology sector, there is automatically a cascading effect on the CRO spending in these areas. Regionally, with increasing outsourcing of the drug development to the Asian countries, the range of services and offerings is only likely to continue. US and Europe garnered an approximate one third market share in revenue terms in 2006.

The first critical step in clinical research outsourcing is to select the right partner. Companies willing to outsource should establish and identify certain criteria important to choosing an outsourcing partner. The potential partner must demonstrate a proven clinical research expertise and companies should evaluate; client lists, the duration of projects, the number of projects, expertise in therapeutic area, quality of the clinical research programmes and the capability of resource allocation, along with cost effectiveness and realistic development time lines. To enable the long-distance monitoring and management of the projects, the potential partners should be able to give a high level of commitment and attention to the client’s need. It is essential to maintain a sustainable balance sheet in the phases (for example, pre-clinical discovery, screening, process development, and the like) prior to having products reaching the market, since the majority of revenues are derived from successful licensing and regulatory approval. The development of patentable products requires healthy investment in R&D and suitable confidentiality of results to develop a strong IP portfolio. To ensure that technology innovation is commercialised to its best potential, companies need to continuously work with domestic government officials and key opinion leaders in establishing and defining standards to comply with regulatory standards. Licensing, outsourcing and research collaboration are the biggest trends at a corporate level in the drug discovery outsourcing industry. Collaborative propositions will be strengthened by strong IP portfolios, broad and versatile product platforms and healthy product pipelines containing therapeutics targeted at a high-growth market. Through collaborations, companies can actively seek to form an industry consortium, work with academic or government institutions and hardware suppliers to establish and define standards. It is recommended that procedures and systems, which meet the principles of good clinical practice for trial management are developed and that these are clearly documented so that adherence is readily demonstrated. For each clinical trial, a risk assessment should generally be undertaken at the protocol development stage. This may be used to plan the details of trial management and to an extent, the monitoring in the trial. These plans should be documented, together with the risk assessment, so that the management strategy is both transparent and justified. The documentation is intended not only to facilitate the management of the trial, but also to help prepare for external audit.

V. Sriram

Research Analyst, Frost and Sullivan

Sriram is a Research Analyst with the European Healthcare Practice at Frost & Sullivan, covering the pharmaceuticals and biotechnology space. He has authored research services on respiratory and oncology markets with a number of articles for Obbec, European Biopharmaceutical Review and Biopharma. He has also been continuously tracking areas including medical devices and clinical diagnostics. His other interests include; security analysis and portfolio management, macroeconomics and marketing.

Prior to joining Frost and Sullivan, Sriram interned at one of the top generic pharmaceutical companies in India where he researched on the bioavailability of Amiodarone Hydrochloride tablets and was responsible for its reformulation and launch.

Sriram has a Bachelor’s degree in Pharmacy from the Birla Institute of Technology and Science, Pilani.