Bristol Myers Squibb agrees nearly $6bn oncology merger

Posted: 9 October 2023 | Catherine Eckford (European Pharmaceutical Review) | No comments yet

In an agreed merger with Mirati Therapeutics, Bristol Myers Squibb will gain rights to a best-in-class treatment for advanced non-small cell lung cancer (NSCLC) with a KRASG12C mutation.

Credit: Tada Images / Shutterstock.com

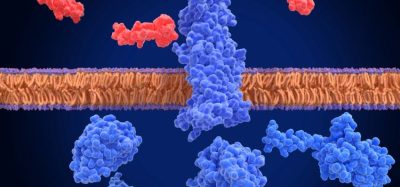

Bristol Myers Squibb (BMS) has agreed to acquire Mirati Therapeutics for a total of $4.8 billion. This merger deal entitles BMS to add KRAZATI (adagrasib), a best-in-class KRASG12C inhibitor to its portfolio. The medicine is approved in the US for advanced KRASG12C-mutated non-small cell lung cancer (NSCLC) in patients who have received at least one prior systemic treatment.

Advantages of KRAZATI include its long half-life. It has also demonstrated efficacy in a Phase I trial as a combination therapy alongside a PD-1 inhibitor in first-line treatment of NSCLC, according to Bristol Myers Squibb.

KRASG12C is the most common KRAS mutation in for this type of lung cancer, occurring in approximately 14 percent of lung adenocarcinoma patients, 2022 research published in the NEJM reported.

Further details of Bristol Myers Squibb’s merger agreement with Mirati Therapeutics

Mirati stockholders will also receive one non-tradeable Contingent Value Right (CVR) for each Mirati share held. This potentially is worth an additional value of $1.0 billion.

Through this acquisition, Bristol Myers Squibb also gains access to several promising clinical assets from Mirati including MRTX1719, a potential first-in-class MTA-cooperative PRMT5 inhibitor in Phase I development. The treatment has shown encouraging early efficacy data in NSCLC, bile duct cancer (cholangiocarcinoma) and melanoma. It has not provided evidence to date of meaningful haematological toxicities associated with non-selective PRMT5 inhibitors. BMS stated that a Phase II clinical trial for MRTX1719 is expected to begin in the first half of 2024.

“By adding assets focused on intrinsic tumour targets in the Methylthioadenosine phosphorylase (MTAP) and Mitogen-activated protein kinase (MAPK) pathways… these have potential to change the standard of care in multiple cancers, both as standalone therapies and in combination with Bristol Myers Squibb’s existing pipeline,” noted Dr Samit Hirawat, Chief Medical Officer and Head of Global Drug Development of BMS.

The merger deal is anticipated to close by the first half of 2024, subject to fulfilment of customary closing conditions.

Related topics

Anti-Cancer Therapeutics, Biopharmaceuticals, business news, Clinical Development, Clinical Trials, Drug Development, Drug Markets, Industry Insight, Mergers & Acquisitions, Therapeutics