Biologics: Teamwork pays off in race to expand market for monoclonal antibodies

Posted: 22 October 2012 | | No comments yet

The first biologic drug – infliximab (Remicade) – was launched in 1998 with initial sales of USD 500 million per annum. By 2010, Reuters’ top 10 drugs by sales included five biologics (Remicade, Enbrel, Humira, Avastin and Humira) generating around USD 34 billion in revenue, including USD 7.4 billion from Remicade1. Reuters have predicted that by 2014, these five will be joined in the top 10 by Herceptin, that their combined sales will be USD 47 billion per annum and that the three top-selling drugs in the world will be biologics. It is fair to say then that biologics are transforming the landscape of the pharmaceutical industry – but how and why have these complex molecules achieved this?

The first biologic drug – infliximab (Remicade) – was launched in 1998 with initial sales of USD 500 million per annum. By 2010, Reuters’ top 10 drugs by sales included five biologics (Remicade, Enbrel, Humira, Avastin and Humira) generating around USD 34 billion in revenue, including USD 7.4 billion from Remicade1. Reuters have predicted that by 2014, these five will be joined in the top 10 by Herceptin, that their combined sales will be USD 47 billion per annum and that the three top-selling drugs in the world will be biologics. It is fair to say then that biologics are transforming the landscape of the pharmaceutical industry – but how and why have these complex molecules achieved this?

The first biologic drug – infliximab (Remicade) – was launched in 1998 with initial sales of USD 500 million per annum. By 2010, Reuters’ top 10 drugs by sales included five biologics (Remicade, Enbrel, Humira, Avastin and Humira) generating around USD 34 billion in revenue, including USD 7.4 billion from Remicade1. Reuters have predicted that by 2014, these five will be joined in the top 10 by Herceptin, that their combined sales will be USD 47 billion per annum and that the three top-selling drugs in the world will be biologics1. It is fair to say then that biologics are transforming the landscape of the pharmaceutical industry – but how and why have these complex molecules achieved this?

Actually, the answer to the ‘why’ question is quite straightforward. They are safer and efficient in their target populations and their target populations are sometimes quite large and other times represent ‘new’ populations for therapy (i.e. there are no current therapeutic options for those patients). These factors combine to make biologics an attractive proposition for big Pharma.

Biologics are genetically-engineered proteins that mimic natural components of the immune system – including T-cells, interleukins, growth factors and interferons – and are highly specific for their targets. They intervene in the processes that cause the patient’s symptoms (usually by shutting down a process that is running out of control) rather than simply alleviate those symptoms. This means that patients not only get rapid and effective control of their disease, but they can also avoid the sometimes debilitating side-effects that frequently accompany long-term use of conventional therapies.

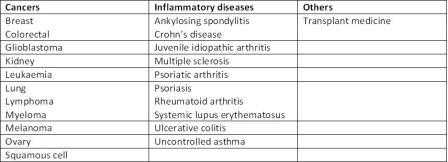

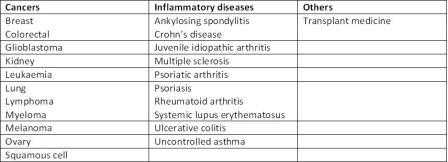

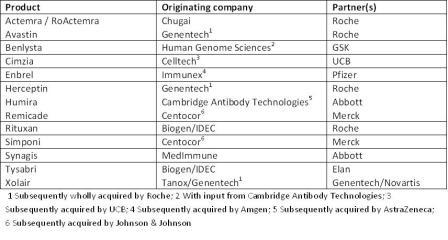

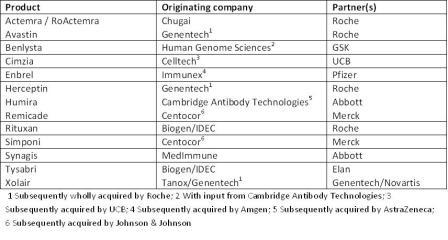

Patients with cancer were early beneficiaries of monoclonal antibody (mAb) therapy (Table 1), as they have proven particularly useful for arresting / reversing the growth of tumours by blocking cell signalling or enhancing the immune response leading to the destruction of cancerous cells.

Table 1: Therapeutic areas currently covered by biologics

In the case of chronic inflammatory diseases such as rheumatoid arthritis, Crohn’s disease and psoriasis, biologics are now the therapy of choice because of their rapid onset of action and improved long-term side-effect profile relative to cortico – steroids. mAbs are used in patients who have undergone transplantation to prevent rejection of the new organ. The ability of biologics directly to influence the disease process has also opened up opportunities in diseases with significant unmet need, such as uncontrolled asthma, systemic lupus erythematosus (SLE), chronic obstructive pulmonary disease (COPD), scleroderma and multiple sclerosis – inflammatory diseases that affect many millions of patients but which have few, if any, specific treatments available – as well as prostate, ovarian and bladder cancers.

Capitalising on their specificity for binding to particular cell types, some mAbs are being investigated as vehicles for delivering conventional chemotherapy or radiotherapy to tumour cells for the treatment of lymphomas, leukaemia and bowel cancer.

The potential value of the markets for these medicines means that pharmaceutical companies place great importance on having good representation of biologics at all stages of their development pipelines. Among the top five pharmaceutical companies, around 50 per cent of their current R&D pipelines are comprised of biologics, and the majority of these are mAbs.

AstraZeneca/MedImmune and biologics

AstraZeneca, through its specialist biologics arm, MedImmune, is similarly committed to leveraging its industry-leading technology to deliver effective and convenient biologic medications for global use.

At MedImmune, projects within our Respiratory, Inflammation and Autoimmunity (RIA) Innovative Medicine Unit represent more than 30 per cent of our overall R&D port – folio, making it our largest area for research. As an illustration of how, within an R&D portfolio, the extent of the knowledge of the disease process (influenced both by the number of patients with individual diseases and the complexity of their aetiology and pathogenesis) can either expedite or frustrate progress, it is also a great ‘case study’!

In the following paragraphs, I will give a flavour of some of the challenges and drivers for developing biologics for RIA diseases, highlight some of the current targets and talk more specifically about MedImmune’s projects in this area.

Respiratory diseases

Respiratory diseases such as asthma and COPD (which encompasses chronic bronchitis and emphysema) are complex inflammatory diseases whose aetiology involves a degree of interplay between genetic, environmental and clinical factors which varies from patient to patient.

Increasing urbanisation is thought to be responsible for a significant increase in the prevalence of asthma2, while COPD, which encompasses bronchitis and emphysema, is set to become the third biggest cause of death in the world, mainly as a result of cumulative tobacco use3. In the past, COPD has been considered to be irreversible, but nowadays a combination of early detection, aggressive smoking cessation programmes and effective medication should at least prevent its progression. Most asthma patients achieve good control with conventional medications, but a significant number have uncontrolled asthma, requiring regular hospitalisation during exacerbations.

Asthma is generally characterised by increased numbers of eosinophils and a range of interleukins (ILs) – including IL-4, IL-5, IL-13 and IL-17 – that play important roles in the survival of eosinophils, or that promote airway hyperresponsiveness, over-secretion of mucus and a reduction in the elasticity of the lungs. These eosinophils activate macrophages that them – selves secrete pro-inflammatory cytokines. Up to a quarter of patients with COPD also have increased eosinophil levels, although it is more common for these patients to have increased neutrophil levels. Activated mast cells secreting IL-8 under the influence of calcium-independent phospholipase A2 (iPLA2) are another feature of COPD.

Benralizumab is an anti-IL-5 receptor alpha mAb, currently in Phase 2 at MedImmune for uncontrolled asthma and eosinophilic COPD. Tralokinumab, another mAb in Phase 2 potently and specifically neutralises IL-13 in adults with severe, persistent uncontrolled asthma. A little further back in our portfolio is MEDI8968, an anti-IL-1 receptor mAb being developed for patients with moderate-to-severe COPD.

Autoimmune diseases

Many of the biologics already on the market are aimed at autoimmune diseases (Table 1) and all of these target B lymphocytes in some way. Tumour necrosis factor alpha (TNFα; which is a popular mAb target) and IL-6 both stimulate the production of B lymphoctyes and are produced by them under the influence of CD22 or CD40. Belimumab, which was the first new anti-SLE drug to be introduced for nearly 60 years when it was introduced in 2011, inhibits the B-cell activating factor/B lymphocyte stimulator (BAFF/BLys). Natalizumab – currently the only mAb available for MS – inhibits α4-integrin (CD49D), which mediates the migration of T lymphocytes to sites of inflammation and their adhesion to other immune cells.

Other B lymphocyte targets in autoimmune diseases include the CD19 and CD20 receptors. In addition, an increasing body of evidence suggests that interferon alpha (IFN-α) plays a central role in the development of SLE and scleroderma, for which no targeted therapy is currently available. Activated CD4+ T helper lymphocytes secrete cytokines that activate B lymphoctyes and other components of the immune system and also represent good therapeutic targets.

MedImmune has a number of candidates for all these targets at different stages of development for SLE, scleroderma, RA, psoriasis and psoriatic arthritis (Figure 1).

Figure 1: MedImmune’s RIA pipeline

Inflammatory diseases

Diseases that involve an inflammatory process but that don’t fall into the previous two categories include atherosclerosis, Alzheimer’s disease (AD), Parkinson’s disease, irritable bowel syndrome, nephritis and some allergies and infectious diseases.

This is a very diverse group – not just in terms of the types of diseases but also in the extent of the understanding of the disease process and clearly represents unmet clinical needs.

The hypothesis that AD might be an IMID emerged relatively recently. It was found that antibodies could be raised against fragments of the Aβ peptide, and that blocking its formation blocked the formation of the amyloid protein fibrils that subsequently form the extracellular plaques characteristic of AD4.

By contrast, the role of inflammation in atherosclerosis and cardiovascular disease is well established. Analysis of infiltrates of atherosclerotic lesions reveals greatly increased numbers of macrophages/monocytes which secrete both cytokines that promote the formation of atheroma and cytokines that promote apoptosis, leading to their rupture. IL-1β and IL-6 are currently the subjects of early stage clinical investigations but a host of potential targets are emerging from in vitro and in vivo studies in this area.

And so to the how…

The discovery process for conventional medicines these days begins with a combinatorial chemistry step – hundreds of experiments using different ratios of the same raw materials and/or under different conditions, either virtually (in computer-aided drug design) or in reality (in multi-well plates) to create libraries of up to millions of potential candidates for screening against a range of potential drug targets (perhaps an enzyme).

Once identified, the pharmacodynamic and pharmacokinetic properties of candidates can be assessed using straightforward analytical techniques to determine the concentration of the drug and its metabolites in various tissues and waste products. The effective/toxic range of the drug can be established in studies in animals and humans.

By contrast, the development of a biologic will start with the deconstruction of the disease process, the identification of biomarkers of disease progression/disease control and specific cells, molecules or fragments of molecules to target. Then comes the process of raising antibodies to the target, finding the best way to deliver the antibody back to the target and only then finding out if the chosen target indeed has the desired effect on the disease process. The patient population then has to be selected and monitored using appropriate biomarkers or other surrogates, as protein-based medicines will be hard, if not impossible, to discern from naturally-occurring proteins.

The nature of this process means that biologics tend to have been ‘discovered’ in small, specialist companies often initially formed as spin-outs from academic research.

We should be plain here, however, that (in the vast majority of cases), whether the originating company is a niche biotech or a big Pharma, sales from the drug product need to cover the cost of its discovery and development and provide some reward for investors – and this at least is likely to require sales in the world’s major markets.

However, whether a potential candidate is a highly specific mAb or a broad-spectrum antibiotic, it should be tested in a patient population appropriate in size and make-up to its likely commercial audience and must undergo extensive rounds of peer review and assessment in order to obtain regulatory approval in each market.

It takes monumental human and financial resources, a global infrastructure and extensive medical, legal and regulatory know-how to launch a drug for a world-wide patient population. Commercial partnerships between companies with expertise in a particular therapeutic and/or geographic area are common even for conventional drugs discovered in sizeable pharmaceutical companies.

Table 2: Examples of fruitful collaborations between biotechs and big pharma

Table 2 indicates how important collabora – tions have already been in developing the markets for biologics, with originator companies benefitting from big Pharma’s financial backing, know-how and global reach and big Pharma benefitting from biotech’s innovation and scientific and technical know-how and both parties being rewarded handsomely in terms of sales.

Going forward, collaborative R&D and commercial agreements are likely to become more important as more biologics targeting some of the world’s biggest health problems – heart disease, COPD, lung cancer, prostate cancer and breast cancer, for example – near approval, and pharmaceutical companies seek to fill holes left in their pipelines by conventional medicines that no longer adequately address patient needs and/or have reached the end of patent protection.

Collaborative R&D in biologics – a case in point

Recently, AstraZeneca – through MedImmune – entered into collaboration with Amgen to develop and commercialise a range of five novel mAbs for RIA diseases from Amgen’s R&D portfolio. Under the terms of the agreement, Amgen benefits from MedImmune’s expertise in this therapeutic area and AstraZeneca’s global reach in respiratory and gastrointestinal diseases, while MedImmune/AstraZeneca benefit from a more complete product pipeline.

Amgen was an early entrant into the biotechnology market place with ‘home-grown’ and in-licensed products. Its product portfolio concentrates on products for kidney disease, neutropenia, bone diseases and cancer. The five mAbs to be codeveloped with MedImmune include one in Phase 2/3 for psoriasis, psoriatic arthritis and asthma and four in Phase 1 for Crohn’s disease, ulcerative colitis, SLE and asthma. Because of their novel profiles, these biologics have the potential to emerge as bestin- class or first-in-class treatments across several indications in inflammatory disease:

- Brodalumab (AMG 827) is the furthest advanced. It binds to and blocks signalling via the IL-17 receptor. Amgen, which will lead the development and comm – ercialisation strategy for brodalumab, is also studying it for use in psoriatic arthritis and asthma. Amgen will promote the product in dermatology indications in the USA and Canada and in rheumatology indications in the USA, Canada and Europe. AstraZeneca will promote it in respiratory indications and initially in dermatology indications in territories outside North America

- AMG 139 is the only other subject of the collaboration to target an interleukin. It neutralises interactions between IL-23 and its receptor while sparing IL-12. This mode of action means that it has potential in a number of RIA diseases but initially is being developed for Crohn’s disease and is currently in Phase 1 trials. MedImmune doesn’t have a proprietary candidate in clinical development for Crohn’s, and this is a product that will extend AstraZeneca’ portfolio of conventional GI products

- AMG 181 is a mAb against the integrin alpha4/beta7, which blocks binding to the immunoglobulin MAdCAM-1 – an endothelial cell adhesion molecule involved in recruiting leukocytes into sites of inflammation. AMG 181 is also being investigated in Crohn’s disease as well as in ulcerative colitis. Phase 1b trials are on-going

- AMG 557 is a mAb that targets B7-related protein (B7RP-1), a membrane protein found on antigen presenting cells and T cells. It is being assessed in Phase 1b trials for utility in autoimmune diseases including SLE. This is a different target to that of MedImmune’s sifalimumab and MEDI-546, which are currently in Phase 2 for SLE but, like MEDI-570 (also in Phase 1) is also targeting the T cells of the cell-mediated immunity cascade. As with brodalumab, Amgen will lead the development of AMG 557

- AMG 157 blocks the interaction between thymic stromal lymphopoietin (TSLP) and the TSLP receptor in a number of different immune cells including dendritic cells, mast cells and lymphocytes. It is currently in Phase 1b for asthma, behind MedImmune’s benralizumab.

Conclusion

Biologic medicines, especially mAbs, have transformed the scientific and commercial landscape of the pharmaceutical industry in the last 15 years and will become more dominant in years to come because of their ability to interrupt disease processes rather than just ameliorate symptoms.

Building on their core markets in cancer, dermatology and rheumatology, it seems likely that biologics will also take strong positions in the major markets of cardiovascular and respiratory medicine, while also continuing to provide solutions for patients with rarer diseases that currently have few therapeutic options.

It is unlikely, however, that this will be achieved without further collaborations between the biotech innovators and big Pharma – an interesting three-way example of which has recently begun between AstraZeneca, its wholly-owned biologics arm MedImmune and biotech founding company, Amgen.

References

- Hirschler B. Factbox – World’s top-selling drugs in 2014 vs 2010. Thomson Reuters; USA (2010). Available at: http://www.reuters.com/article/ 2010/04/13/roche-avastin-drugsidUSLDE63C0BC20100413 (last accessed 19 June 2012)

- Cruz AA, Bateman ED, Bousquet J. The social determinants of asthma. Eur Resp J 2010;35:239–242

- Bousquet J, Khaltaev N (Eds). Global surveillance, prevention and control of chronic respiratory diseases – A comprehensive approach. World Health Organization; Geneva, Switzerland (2007)

- Morgan, D. Antibody therapy for Alzheimer’s disease. Expert Rev. Vaccines. 2003;2(1):89-95

About the author

Dr. Bahija Jallal is Executive Vice President of Research and Development with oversight for research, development and clinical activities based at MedImmune’s Gaithersburg, California and Cambridge, UK sites. Dr. Jallal joined MedImmune as Vice President, Translational Sciences, in March 2006 and has been in positions of increasing responsibility.

She has authored over 60 peer-reviewed publications and has over 15 patents. She is a member of multiple research associations and organizations promoting women in science. In 2011, she was named one of FierceBiotech’s Women in Biotech. Prior to joining MedImmune, Dr. Jallal worked with Chiron Corporation where she served as vice president, drug assessment and development, and successfully established the company’s translational medicine group. Prior to Chiron Corporation, she worked at Sugen, Inc. where she held positions of increasing responsibility leading to Senior Director, Research.

Dr. Jallal received a Master’s degree in biology from the Universite de Paris VII in France, and her Doctorate in physiology from the University of Pierre & Marie Curie in Paris. She conducted her Postdoctoral research at the Max-Planck Institute of Biochemistry.