Seven secret ingredients for successfully launching and commercialising a biopharma’s first drug in Europe

Posted: 23 December 2020 | Christian Schuler (Simon-Kucher & Partners) | No comments yet

After the US, Europe is considered the second most attractive market for serving patient needs while realising commercial value from innovative drugs. However, the 27 EU member states each have their own approaches to pricing and market access – and need tailored commercialisation and go-to-market strategies. Simon-Kucher & Partners analysed over 20 prominent first drug launches by US-based companies in Europe, assessed over 4,500 individual data points from independent launches and conducted interviews with 18 senior executives. Christian Schuler, a Senior Partner at the company, discusses the key value drivers and success factors for US-based biopharma companies when independently launching their first drug in Europe.

First drug launches in Europe: identifying common patterns

For every example of successful launches, there are others where companies could not fulfil their own high expectations, or those of shareholders”

From 2005 to 2019, over 650 innovative medicinal products received initial marketing authorisation from the European Medicines Agency (EMA). Only a fraction were driven by companies establishing their own commercial operations in Europe for the first time. We analysed drug and indication characteristics of 20 first product launches by US-based companies, including indication size (prevalence), unmet medical need, disease severity, the drug’s current and future competitive strength, differentiation potential and the yearly price achieved. In addition, we assessed company characteristics, such as pipeline strength, finances and strategic outlook to understand value drivers behind the commercialisation efforts.

In total, 16 out of 20 new drug launches (80 percent) analysed had received an EMA orphan drug designation, making an independent launch more attractive. Ultimately, the decision to independently launch a drug depends on the way biopharma companies create value. The majority were launched in areas with high disease severity, a high unmet medical need and were for a well-defined, distinct patient population. Since the revenue potential of a drug is its price multiplied by volume, a high price point is required to balance out a lower market volume for the commercial sustainability of a therapy.

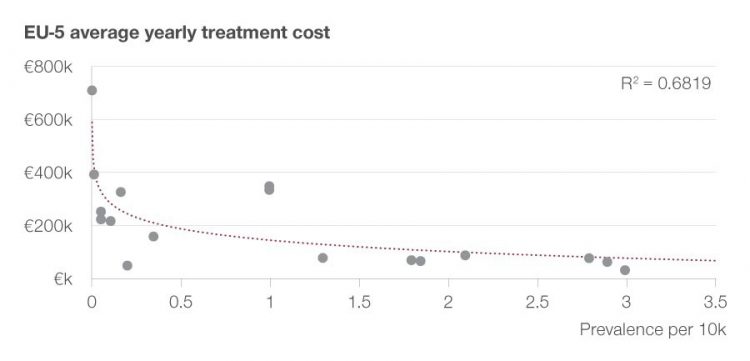

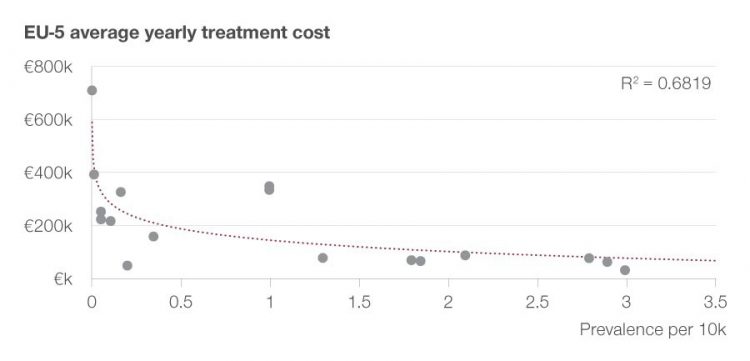

Figure 1: Achieved target price of drug depending on disease prevalence.

A multiple linear regression analysis assessing price by size and age of patient population, unmet need, severity of disease and a drug’s therapeutic improvement underlines the relationship between these important variables (r: 0,78; R²: 0.61). However, achievable drug prices are the result of many factors, including the value perception by payers and the negotiation excellence of the respective biopharma company.

Opportunities and reasons to commercialise: striving for increased shareholder value

In addition to putting patients at the core of all actions, emerging biopharma companies strive to perform well financially and create shareholder value. Other motivations for an independent launch include the desire to establish a platform for subsequent drug launches; the flexibility to have full control over an asset and the organisation; and unforeseen circumstances that force the company to independently commercialise a drug on its own. To succeed in the long term, it is necessary to accept short-term losses. Establishing commercial operations in the EU-5 and other EU markets via a country-clustering approach (eg, Nordics) can generate costs of between €60m and €120m per year. But the revenue upside can also be substantial and launching an innovative drug “alone” in Europe can offer positive 10-year net present values (NPVs) of several hundred million euros, but obviously at a significantly higher risk than partnering or out-licensing the asset.

For every example of successful launches, there are others where companies could not fulfil their own high expectations, or those of shareholders. The reasons are manifold, including limited robustness and quality of clinical evidence for the drug, a lack of engagement with key medical and payer stakeholders, an inadequate pricing and market access strategy, or a mismatch between the value perceived by the company and that perceived by European payers.

Seven secret ingredients for success: pursuing the full realisation of a drug’s economic value

- Gain new perspectives (early on): All experts were concerned about common traits shared by the senior executives of emerging biopharma companies. Either they are too research-focused and do not take commercial considerations into account during drug development, or they are too focused on excelling in the US and fail to understand the global potential of their drug. Bringing on board an EU Chief Commercial Officer or a Vice President (VP) for commercial affairs or pricing and market access (P&MA) early on for the planned EU commercialisation may provide the necessary guidance.

- Debias your assumptions; be a challenger: The executives of emerging biopharma companies in the US tend to overestimate the therapeutic improvement of their drug based on false assumptions, fail to identify other differentiation opportunities and can be reluctant to update their beliefs in the face of new evidence. It is important to realise these and other biases exist. Therefore, it is important to create a collaborative atmosphere characterised by an open exchange without specific constraints. Consulting external experts can bring in new perspectives and challenge existing mindsets. The depth of this collaboration should increase with each development stage.

- Tear down existing silos: Launching in Europe is daunting and complex. Patient advocacy groups are gaining increasing influence on the outcome of regulatory assessments and decision-making shifts away from physicians toward payer-supported treatment guidelines/algorithms. Nearly 80 percent of the respondents highlighted the importance of close collaboration between all departments at global, regional and local levels to develop a fully integrated commercial strategy. A best practice is to engage early on with regional regulatory bodies and country-specific payer authorities to understand key requirements for the ideal clinical trial design and successful approaches to pricing and market access.

- Build a tailored operational model for Europe: A company’s operating model should enable collaboration between and within global, regional and country-affiliate divisions. Our findings suggest building up a regional headquarter with affiliates in the EU-5 – alongside the European GM – with each of the key functions (P&MA, medical, commercial and pharmacovigilance/clinical trial operations) represented by a VP or head of department. Despite the extra cost, all participants believe decisions cannot be made solely from the US and warn that adding extra work on top of the US-focused activities will demotivate and frustrate employees. At a country-level, especially in the EU-5, market specifics require a minimum number of leading medical, P&MA and marketing functions. Our experts recommend looking for the right talents as early as possible, ideally two to three years prior to the planned EU launch. For affiliates with longer P&MA timelines, GMs should plan the commercial affiliate organisation conservatively to account for delays. Not draining the bottom line while no commercial sales are being made is as important as being ready to switch to launch mode quickly to boost the top line following a successful pricing and market access negotiation in a particular country.

- Create awareness and differentiate: Companies need to be patient-centric to properly address needs, create awareness about the disease, train professionals and ensure patients get sufficient access to medication. The company should act as an integrated (service) partner for patients. Regulators, HTA agencies and payers often turn to patient advocacy groups and key opinion leaders to gain insight into the actual incremental benefit of a drug and rely on their input. Due to the smaller patient population sizes involved, companies should address the market through a multi-channel approach where Medical Science Liaisons (MSL) ensure acceptance and endorsement from key opinion leaders (KOLs) and patient advocacies.

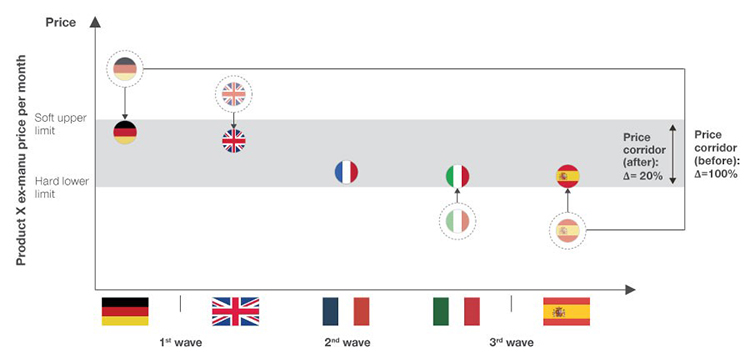

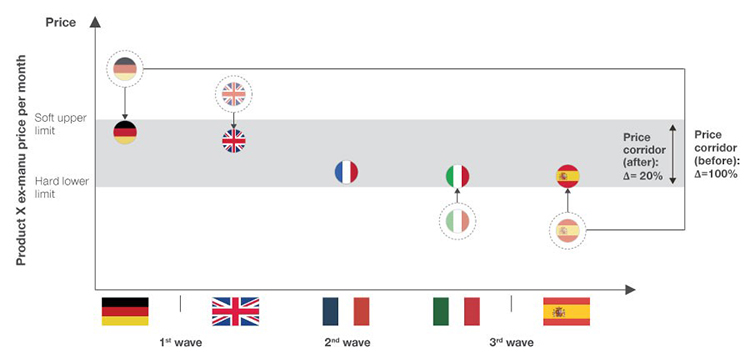

- Excel in P&MA – if you make it there, you can make it everywhere: It is important to assess and understand a drug’s country-specific market access potential. This involves understanding the asset’s advantages, disadvantages, perceived therapeutic value and the strategic implications of treatment pathways and respective funding flows. Management must incorporate these observations in a cross-country assessment of pricing potential that includes clinical and market access scenarios tailored to the specific nature of the drug. Innovative access agreements, such as payment by results, risk-sharing or annuity payments may become necessary for “targeted needs” as they often come with clinical limitations. Manufacturers must not only convince payers of the benefits of their drug but also be willing to collect and grant access to real world evidence within legal boundaries. Further, it is important to consider country-optimal pricing strategies in an international context due to formal and informal international price referencing/re-referencing. This may include deviating from the country-individual optimal price strategy to optimise P&MA across the entire European region.

Figure 2: Conceptual launch timeline and price strategy considerations.

- Leverage alternative access programs to support your P&MA and commercial strategy: Alternative access programmes (AAPs) can create true value for patients and grant access to an urgently needed treatment outside of the standard reimbursement pathways. The most common types of programmes are early access or compassionate use. AAPs allow companies to build up a patient base that becomes fully commercially viable upon reimbursement. They allow real-world evidence to be collected, which can influence future therapy management and algorithms. Moreover, AAPs help create awareness and goodwill among key (clinical) stakeholders, which may positively impact payer and regulatory discussions and decisions.

Conclusion

All our study participants believe that it was the right decision to commercialise their lead drug on their own in Europe in order to create significant patient value, lay the foundation for future launches and support the international growth of their companies, as well as increase their shareholder value. All the participants’ products and market situations were different, as will the future biopharma market situation. Nevertheless, a few managerial considerations hold true for any emerging biopharma company to apply the seven secret ingredients successfully.

About the author

Christian Schuler is Senior Partner in the Life Sciences division of Simon-Kucher, working for the past six years out of the company’s office in San Francisco, USA and has recently relocated to Munich, Germany. Previously, he worked for eight years in the company’s headquarters in Bonn, Germany.

Christian specialises in strategic pharmaceutical marketing, value-to-customer, market entry strategies, P&R strategies, innovative pricing strategies, product lifecycle strategies, generics defense strategies, licensing & valuation, commercialization strategies and market forecasting.

Since joining Simon-Kucher, he has conducted in-depth research and data analysis for life sciences companies and has developed various national and international pricing and market entry strategies for new chemical entities, medical devices and scientific equipment. He has supported several top-25 pharma, biotech and medtech companies as well as start-up life sciences companies in successfully commercialising their life sciences innovations.

Related topics

Biopharmaceuticals, Drug Markets, Industry Insight, Therapeutics