PharmaChemical Ireland launch innovation and excellence strategy in New York

Posted: 16 December 2010 | | No comments yet

PharmaChemical Ireland published a major strategy document in March 2010. The document, titled, ‘Innovation and Excellence-PharmaChemical Ireland Strategic Plan’ was launched at the Drug Chemical and Allied Technologies (DCAT) meeting at the Waldorf Astoria, New York City on 16 March 2010. The document outlines the industry response to the major challenges being faced by the global industry.

PharmaChemical Ireland published a major strategy document in March 2010. The document, titled, ‘Innovation and Excellence-PharmaChemical Ireland Strategic Plan’ was launched at the Drug Chemical and Allied Technologies (DCAT) meeting at the Waldorf Astoria, New York City on 16 March 2010. The document outlines the industry response to the major challenges being faced by the global industry.

PharmaChemical Ireland published a major strategy document in March 2010. The document, titled, ‘Innovation and Excellence-PharmaChemical Ireland Strategic Plan’ was launched at the Drug Chemical and Allied Technologies (DCAT) meeting at the Waldorf Astoria, New York City on 16 March 2010. The document outlines the industry response to the major challenges being faced by the global industry.

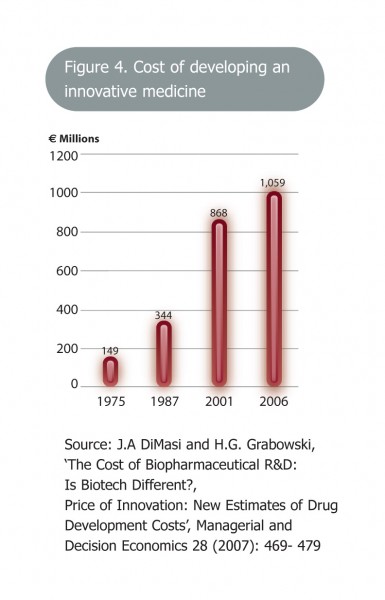

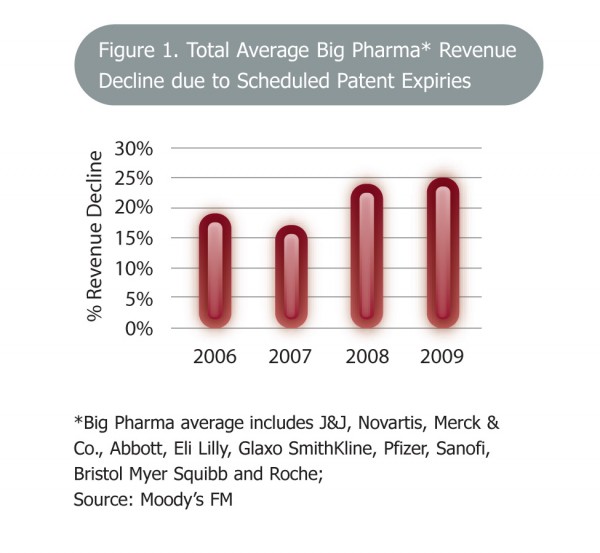

It is well known that the global pharmaceutical, biopharmaceutical and chemical industries face a challenging decade ahead. A major driver of this will be the patent expiry of a number of blockbuster drugs manufactured in this country. Once a blockbuster comes off patent, revenues fall sharply by up to 80 per cent. Many commentators predict a drop in revenues of as much as EUR 100 billion over the next five years. In the past, research pipelines provided replacement products for these drugs, unfortunately such pipelines are now far less productive, meaning that companies will need to pursue alternative strategies to survive. An initial response by big pharma has been to merge. The recent Pfizer-Wyeth and Merck-Schering Plough mergers are examples of this as companies seek to enhance their product and research portfolios.

This scenario presents a set of real challenges for the industry in Ireland as it prepares to absorb the effects of the first of these major patent expiries – that of Pfizer’s Lipitor – in 2011. Exporting products valued at EUR 47 billion in 2009, the sector is enormously important to the Irish economy, therefore it is paramount that the industry is well prepared for these challenges.

Figure 1 Total average Big Pharma* revenue decline due to schedules patent expiries * Big Pharma average includes J&J, Novartis, Merck & Co., Abbott, Eli Lilly, GlaxoSmithKline, Pfizer, Sanofi, Bristol-Myers Squibb and Roche Copyright: Moody’s FM

Strategy Working Group

In order to come up with a coherent and well thought out response, PharmaChemical Ireland (PCI) established a group comprising industry heads to prepare a plan. They consulted widely among the sector here, with other industry sectors such as medtech and ICT, the research community and Government and its agencies. This period of consultation prompted placing this group onto a standing footing and to widen its membership to include strategic partners to the industry such as IDA Ireland, Enterprise Ireland, Science Foundation Ireland, University College Dublin, University College Cork, Trinity College Dublin, The Department of Enterprise, Trade and Innovation – part of the Irish Government, NIBRT and Forfas. This standing committee was responsible for the final strategy which was published earlier this year. The same committee is responsible for the execution of the strategy (see Box 1).

Future shape of the industry in Ireland

The membership of PCI has defined what characteristics each site must possess if it is to survive in the long term, the so-called factory of the future. These are summarised below:

- Highly-efficient, cost-effective manufacturing with full implementation of the principles of lean manufacturing and operational excellence

- Best practice in regulatory management, including principles of quality by design and process analytical technology

- On-site process and product development capabilities fully integrated into manufacturing

- Site of choice for transfer of all new entities to market

- Flexible and adaptable production facility

- On-site pilot plant facilities

- An on-site unit aimed at training the workforce in the latest principles of Lean, Six Sigma, etc

- Fully networked and research infrastructure

- Best practice in systems and information management

- Best in class in all aspects of environment and health and safety (EHS) management

- A fully-integrated development network for overall corporate structure

- Capacity and capability for clinical trials manufacture

- Regional HQ status for supply chain components, where it makes economic sense to concentrate them at one location

- A strong local management team

- A flexible workforce that can facilitate change on an ongoing basis

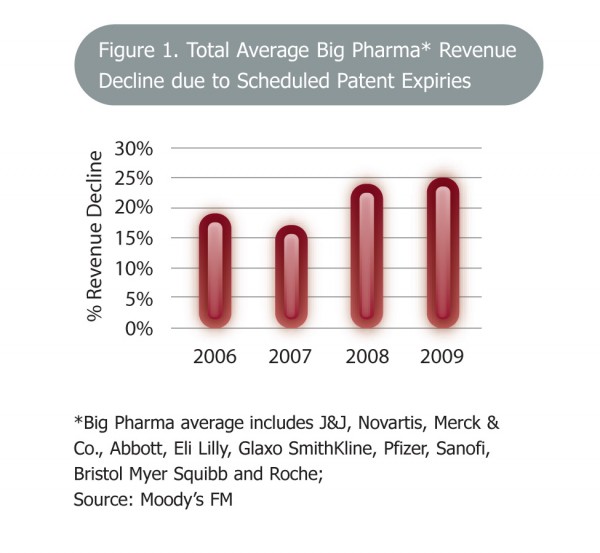

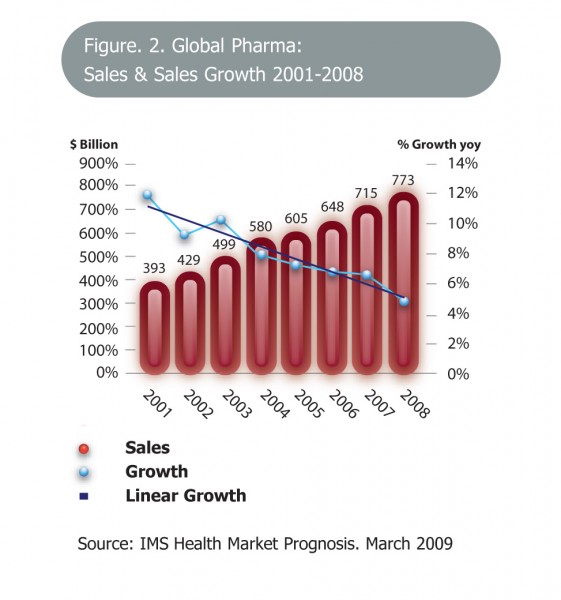

Figure 2 Global Pharma: sales & sales growth 2001 – 2008 Copyright: IMS Health Market Prognosis, March 2009

How can the industry achieve this?

PCI has clearly identified a range of measures that need to be taken by companies themselves if they are to become factories of the future. A number of companies are already well on the way to attaining this status and becoming strategically relevant within their own corporate networks. These are summarised below:

- Companies need to strive to be regarded as lean by closely monitoring and bench – marking those key indicators that allow them to track their own efficiency and productivity

- The industry must persuade companies to invest in on-site innovation – this should include process optimisation, product development and clinical trial manufacture, scale up and technology transfer

- The industry must establish a rationale for conducting or co-ordinating clinical trials out of Ireland

- In collaboration with the Government and the research community, industry should prepare a comprehensive marketing plan for an Irish life sciences cluster. The plan would address all components of a successful cluster such as industry, research centres, Government agencies and all other supporting cluster components. Consideration should be given to positioning the country as a bridge between the US and Asia

- Companies and their supply bases must reduce their operating costs across the board in order to recover relative competitiveness within their own corporate networks. All cost components, including labour, energy, cost of capital, waste treatment, local authority charges, etc, need to be controlled

- Companies need to actively invest in up-to-date regulatory approaches, such as those which have been identified by the FDA in its 21st Century Initiative, including Quality by Design, Process Analytical Technology, etc. It is important that companies apply these principles rigorously to achieve real efficiencies and cost savings through reduced testing and regulatory track streamlining

PCI operates a wide range of specialist working groups and networks that actively work to promote these areas. There is a strong tradition of collaboration in Ireland where companies regularly come together to share best practice and to learn from each other. PCI has produced two reports that benchmark the performance of the sector in operational excellence. Many Irish sites are now well advanced in this space, principles such as lean and six sigma have become the norm for Irish operations.

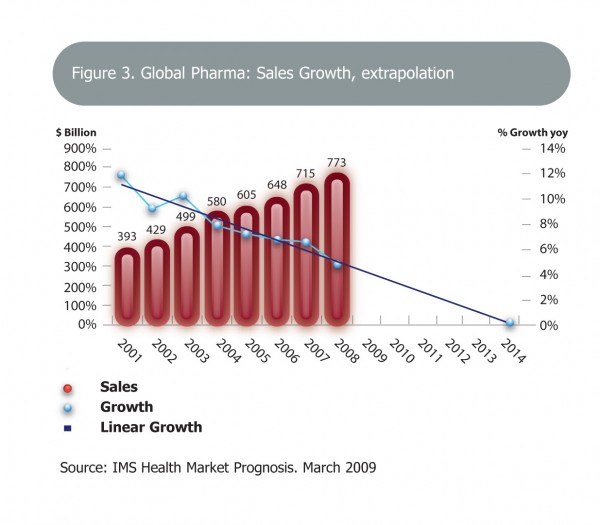

Figure 3 Global Pharma: Sales growth, extrapolation Copyright: IMS Health Market Prognosis, March 2009

What does Government do?

Given the strategic importance of the sector to the economy here (over 50 per cent of all merchandise exports are pharmachem related), it is vital that Government works closely with the industry to assist it in achieving its aims. Traditionally, Government has been very supportive of the sector in Ireland. This support is set to continue:

- Government continues to endorse the 12.5 per cent rate for corporate tax and it is likely that it will remain in place well into the future

- The government stimulates investment in R&D via a tax credit scheme; this tax credit was recently increased from 20 per cent to 30 per cent

- The government has committed to fund the National Bio-processing Research and Training Centre. This is a welcome development and will provide valuable support to the bio-pharmaceutical sector. However, if the pharmachemical sector as a whole is to broaden its remit to embrace process development in a meaningful way, it will be necessary to expand the centre to support the chemical and the specifically pharmaceutical part of the industry, commonly referred to as ‘small molecule’

- The Enterprise Strategy Group recommended that public funding for applied research and in-firm R&D should be progressively increased to match that provided by the Department of Enterprise Trade and Employment for basic research. This includes support for in-firm capability, development, commercialisation and cluster- led academic research and innovation partnerships. There are some notable examples of how this approach has already paid dividends through the Science Foundation Ireland (SFI) sponsored Centres for Science, Technology and Engineering (CSETs) and the Strategic Research Cluster in crystallisation, recently established out of the University of Limerick

- The sector is highly regulated by a number of state bodies including the IMB, HSA and EPA. Additionally, the industry is subject to regulatory oversight from the US-based FDA and European EMA. Compliance levels remain very high in the sector in Ireland

The role of research

Central to the PCI strategy is the growth of development activities within the sector, thereby anchoring manufacturing along the so-called development + manufacturing (D+M) model and positioning Irish sites to be the sites of choice for new product launches, bringing them more centre stage in global supply chains. Therefore, it is vital that the industry collaborates actively with the research community in order to build this type of capability both on site and in the research infrastructure. The government has invested significant amounts into the research sector via the HEI-backed Programme for Research into Third Level Institutes (PRTLI), which in turn has invested in a major infrastructure programme. The government has also committed major funding to the research base via SFI, prioritising life sciences.

This has resulted in the establishment of an interesting research base in the country. A notable example of this is the Solid State Pharmaceutical Cluster (SSPC) which is an excellent example of collaboration between industry, Government (SFI) and the research community. The SSPC concentrates on the area of pharmaceutical crystallisation, studying the prediction and physical properties of pharmaceutical powders. A number of universities and pharmaceutical companies actively collaborate in a number of research areas and they are actively working in the developing quality by design models in the crystallisation space.

SFI also sponsors Centres for Science Technology and Engineering (CSETs) which also bring together SFI, industry and the research community. There are a number of these spanning such areas as probiotics, stem cell research and systems biology.

Conclusion

If Ireland is to sustain its leading position as a global supplier of pharmaceutical and biopharmaceutical and chemical products, the pharmaceutical, biopharmaceutical and chemical supply sectors will have to transform. This transformation will take place at company level, with the government, its agencies and the research sector playing a key collaborative role in this process.

Manufacturing alone will not be enough to ensure the long-term presence of the industry in Ireland. Research, development and innovation will drive the transformation process forward. Many factors present hurdles, including expiry of patents on blockbuster drugs manufactured in Ireland, a rising cost base, competition from Asia and other locations and the further consolidation of supply-chains. These factors will erode the country’s manufacturing base unless action is taken.

Companies need to embrace the concepts of manufacturing and supply-chain excellence, as well as those of on-site innovation, such as process and product development. Ultimately, if Irish sites achieve this goal and the country can become a global centre of excellence for development and manufacturing, they will be well positioned to participate meaningfully in discovery-related activities. In addition, opportunities for indigenous companies in areas such as high-end synthesis, biotechnology, contract research, specialist centres and contract manufacturing will inevitably emerge. Hence, a much more embedded, integrated and sustainable sector will emerge.

In order to achieve these goals, it is necessary that stakeholders are aligned in a collaborative manner. Ireland does not have the time or resources to duplicate its effort. Now is the time to be smart and agile. The existing Government support network and the local management of pharmachemical companies in this country are strong and integrated. It should be more than possible to build upon this strong history and for this country to move on to become a centre of manufacturing excellence and innovation.

Reference

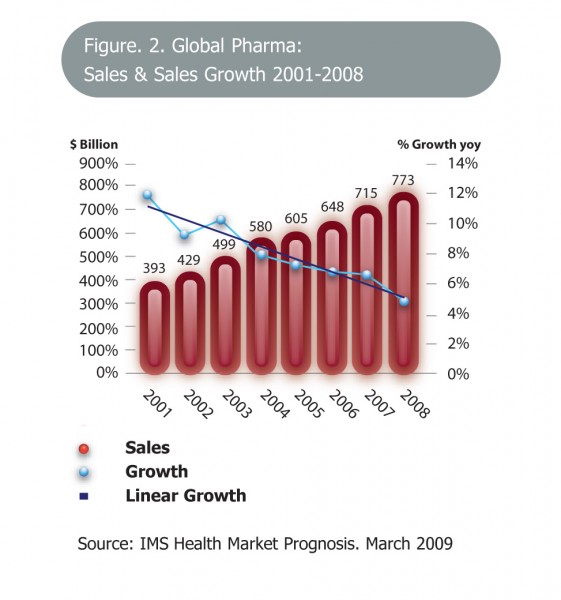

1 . J.A. DiMasi & H.G. Grabowski (2007) ‘The Cost of Biopharmaceutical R&D: Is Biotech Different?, Price of Innovation: New Estimates of Drug Development Costs’, Managerial and Decision Economics 28: 649-479

About the Author

Matt Moran

Matthew Moran is Director of PharmaChemical Ireland. He graduated in Chemistry and Chemical Engineering in 1981 and also holds an MBA. He worked for over 10 years in the pharmaceutical industry where he held a number of management positions both in active ingredient and dosage form manufacture. Matthew Moran is also founder of the Irish BioIndustry Association (IBIA). He is a member the European Chemical Industry Council (CEFIC). Matthew Moran is Vice-President of the Active Pharmaceuticals Ingredients Committee of CEFIC (CEFIC/APIC). PharmaChemical Ireland represents the interests of the pharmachem sector in Ireland. The Irish BioIndustry Association promotes the needs of the biotech sector.