Slow CMO revenue growth could impact US

Posted: 5 November 2020 | Hannah Balfour (European Pharmaceutical Review) | No comments yet

Dose contract manufacturing organisations (CMOs) had slow revenue growth in 2019, a trend continuing into 2020 that could impact the US.

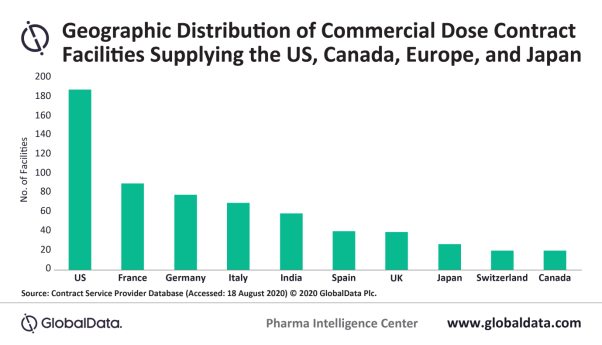

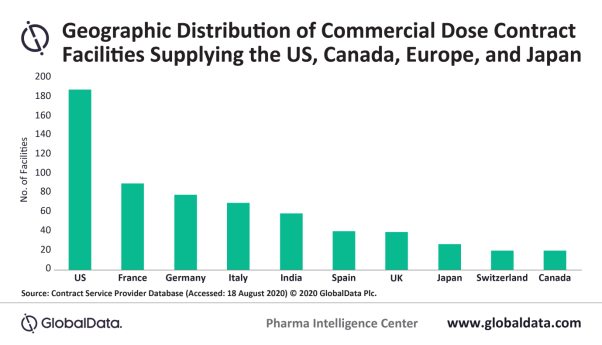

According to researchers, the contract revenue growth for dose contract manufacturing organisations (CMO) in 2019 was at one of the lowest rates since 2012 (3.1 percent). The team suggest that due to its high number of dose CMO facilities, the US could be impacted most by the slow growth.

Adam Bradbury, Pharma Analyst at GlobalData, explained: “The dose CMO industry’s revenue growth has slowed this year and continues to grow at a reduced rate compared to the active pharmaceutical ingredient (API) small molecule and API large molecule segments. API manufacturers begin to benefit from drug development at its earliest stages, with some clinical trials using solely APIs instead of formulated clinical supplies during early Phase I trials.”

According to the report, the US could be more impacted by the reduction in growth rate than other countries because it has the highest number of CMO facilities (118 in total). India, France, Germany, Italy, Spain and the UK are the six other countries with the most commercial dose facilities. The US also has 123 solid dose; 65 injectable; and 64 non-sterile semi-solid and liquid dose manufacturing facilities, which GlobalData reports is the largest number of sites for these individual dosage forms.

Bradbury added: “India’s place as one of the top five countries for dose facilities is impressive and shows the location’s appeal for CMO manufacturing, because there are also many Indian CMOs that only supply domestic drug companies and do not have approvals to supply to the US, Europe and Japan – a requirement of being a part of the dose CMO universe.

“Despite India’s large influence on drug production, there have been notable supply chain disruption this year. In March 2020, the Indian government restricted the export of 26 APIs and finished dose drugs made with those APIs in response to COVID-19…, although these restrictions were later reversed.”

Related topics

Contract Manufacturing, Drug Manufacturing, Drug Markets, Industry Insight