Sanofi to acquire haemophilia specialists Bioverativ for $11.6bn

Posted: 22 January 2018 | Dr Zara Kassam (European Pharmaceutical Review) | No comments yet

Sanofi and Bioverativ Inc., have entered into a definitive agreement under which Sanofi will acquire all of the outstanding shares of Bioverativ…

Sanofi and Bioverativ Inc., a biopharmaceutical company focused on therapies for haemophilia and other rare blood disorders, have entered into a definitive agreement under which Sanofi will acquire all of the outstanding shares of Bioverativ for $105 per share in cash, representing an equity value of approximately $11.6 billion (on a fully diluted basis). The transaction was unanimously approved by both the Sanofi and Bioverativ Boards of Directors.

“With Bioverativ, a leader in the growing haemophilia market, Sanofi enhances its presence in speciality care and leadership in rare diseases, in line with its 2020 Roadmap, and creates a platform for growth in other rare blood disorders. Together, we have a great opportunity to bring innovative medicines to patients worldwide, building on Bioverativ’s success in driving new standards of care with its extended half-life factor replacement therapies,” commented Olivier Brandicourt, Sanofi’s Chief Executive Officer. “Combined, we will continue to leverage our scientific know-how, disciplined focus and development expertise that best position us to drive value for our shareholders and create breakthrough treatments for patients.“

Bioverativ Chief Executive Officer, John Cox, noted, “Bioverativ was created to bring meaningful progress to people living with haemophilia and other rare blood disorders, and I am extremely proud of the accomplishments we’ve made toward that mission over the past year. We have expanded upon the success of Eloctate and Alprolix, which are making a difference in the lives of people with haemophilia every day, and built a pipeline of novel programs for people with rare blood disorders. Sanofi brings proven capabilities and a global infrastructure, which we believe will help to more rapidly expand access to our medicines globally and further our mission of transforming the lives of people with rare blood disorders. Our Chairman, Brian Posner, our entire Board and I strongly believed our spin-off would create meaningful value for shareholders, and this transaction delivers tremendous value for the shareholders who have invested in and supported our mission.”

Creating a leading haemophilia portfolio

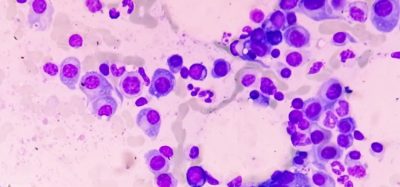

With approximately $10bn in annual sales and 181,000 people affected worldwide, haemophilia represents the largest market for rare diseases and is expected to grow above 7% per year through 2022. Treatment options for patients are shaped by shifting standards of care worldwide and include prophylaxis and extended half-life products, and the development and adoption of innovative therapies.

Bioverativ’s extended half-life therapies, Eloctate [Antihemophilic Factor VIII (Recombinant), Fc Fusion Protein] and Alprolix [Coagulation Factor IX (Recombinant), Fc Fusion Protein] for the treatment of haemophilia A and B, respectively, represented the first major advancements in the haemophilia market in nearly two decades when launched. In 2016, Bioverativ generated $847 million in sales and $41 million in royalties.

Bioverativ currently markets the two products in the United States, Japan, Canada and Australia, and plans to expand into additional geographies. The therapies are also commercialised in the European Union and other countries under a collaboration agreement.

Sanofi believes factor replacement therapy will remain the standard of care in haemophilia for many years due to excellent safety and its increasingly superior long-acting profile. Sanofi will be able to leverage Bioverativ’s clinical expertise and existing commercial platform to advance fitusiran, an investigational RNA interference (RNAi) therapeutics for haemophilia A and B, with or without inhibitors. Sanofi recently announced a restructuring of its rare disease alliance with Alnylam Pharmaceuticals, with Sanofi obtaining global development and commercialisation rights to fitusiran.

One of the priorities of Sanofi’s 2020 roadmap is to “Reshape the Portfolio” and focus on areas where the company currently has, or can effectively build, a leadership position. The addition of Bioverativ supports this priority by adding to our portfolio a differentiated offering of innovative therapies and providing a platform for growth in rare blood disorders, which will expand our presence in speciality care, further strengthen our leadership position in rare diseases and meet the needs of the patient community.

Beyond its two marketed products, Bioverativ’s pipeline includes a program in Phase 3 testing for cold agglutinin disease, and early-stage research programs and collaborations in haemophilia, and other rare blood disorders, including sickle cell disease and beta thalassemia. Sanofi’s R&D organisation will support Bioverativ in bringing these important therapies to patients faster. Furthermore, Sanofi’s global presence, proven expertise and success in launching speciality medicines, and established a footprint in key emerging markets will help Bioverativ fully capitalise on growth opportunities for Bioverativ’s current and future products.

Delivering Shareholder Value

The addition of Bioverativ is expected to drive meaningful value for Sanofi’s shareholders, with strong cash flows from Bioverativ’s growing products expected to increase Sanofi’s financial and operational scale. The acquisition is expected to be immediately accretive to Sanofi’s Business EPS in FY2018 and up to 5% accretive in FY2019. Sanofi is also projected to achieve ROIC in excess of the cost of capital within three years. Sanofi expects to preserve its strong credit rating.

Transaction Terms

Under the terms of the merger agreement, Sanofi will commence a tender offer to acquire all of the outstanding shares of Bioverativ common stock at a price of $105 per share in cash. The $105 per share acquisition price represents a 64 percent premium to Bioverativ’s closing price on January 19, 2018.

The consummation of the tender offer is subject to various conditions, including the tender of at least a majority of the outstanding Bioverativ shares, redelivery of a tax opinion delivered at signing, the expiration or termination of the waiting period under the Hart Scott Rodino Antitrust Improvements Act and receipt of certain other regulatory approvals, and other customary conditions.

Following the successful completion of the tender offer, a wholly owned subsidiary of Sanofi will merge with Bioverativ and the outstanding Bioverativ shares not tendered in the tender offer will be converted into the right to receive the same $105 per share in cash paid in the tender offer. The tender offer is expected to commence in February 2018.

Sanofi plans to finance the transaction with a combination of cash on hand and through new debt to be raised. The tender offer is not subject to any financing condition. Subject to the satisfaction or waiver of customary closing conditions, the transaction is expected to close within three months.

Lazard is acting as the exclusive financial advisor to Sanofi. Guggenheim Securities and J.P. Morgan Securities LLC are acting as financial advisors to Bioverativ. Weil, Gotshal & Manges LLP is serving as legal counsel to Sanofi. Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to Bioverativ.