Has pharma abused the US COVID-19 small business loans system?

Posted: 28 September 2020 | Hannah Balfour (European Pharmaceutical Review) | No comments yet

A review suggests some large pharma companies were approved to receive paycheck protection program (PPP) loans that were intended to help small US businesses to pay workers during the COVID-19 pandemic.

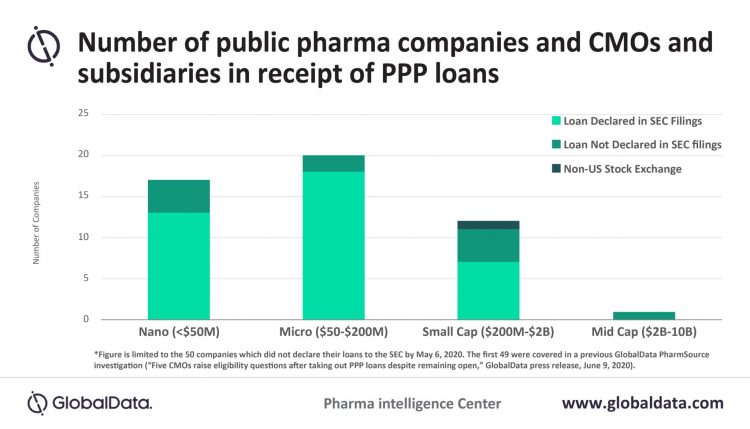

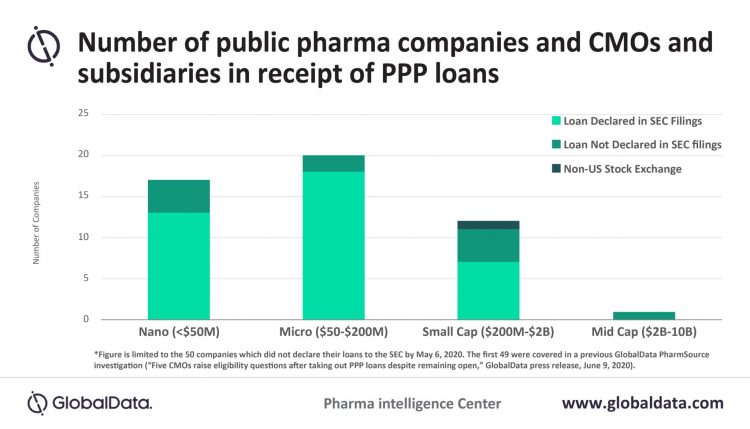

According to a review of information released by the US Small Business Administration (SBA), more than 99 publicly owned pharmaceutical companies and contract manufacturing organisations (CMOs) were approved to receive PPP (paycheck protection program) loans that were intended to help small businesses in the US to pay workers during the COVID-19 pandemic.

Fiona Barry, Associate Editor of GlobalData PharmSource, explained: “These loans were intended for small companies that were hit hard by the COVID-19 pandemic and that could not otherwise afford to retain their staff. While some of these publicly owned pharma companies have small market caps and could argue that they had genuine financial pressures, others are very large. The largest, Sorrento Therapeutics, has a market cap in the billions of dollars, while a further 12 had market caps over $200 million.”

According to the GlobalData investigation, 14 of the companies had not declared their PPP loans in their US Securities and Exchange Commission (SEC) filings by 12 August 2020 (See Figure 1). SEC is a government regulatory agency responsible for protecting investors, maintaining fair and orderly functioning of the securities markets and facilitating capital formation.

Figure 1: Graph of the number of public pharma companies, CMOs and subsidiaries in reciept of PPP loans.

Barry stated: “While there is no legal requirement for companies to disclose PPP loans, a senior securities fraud and corporate governance litigator I interviewed stated that it comes down to materiality: is it information that a reasonable investor would want to know? A good argument could be made that it certainly is, because of regulatory scrutiny and potential reputational harm.”

Related topics

Contract Manufacturing, Funding, Industry Insight, Outsourcing, Viruses

Related organisations

GlobalData, Sorrento Therapeutics, US Small Business Administration (SBA)