Merck to acquire Imago for $1.35 billion

Posted: 22 November 2022 | Catherine Eckford (European Pharmaceutical Review) | No comments yet

Merck has signed agreement to acquire Imago for $1.35 billion to further investigate potential of bomedemstat for myeloproliferative neoplasms and other bone marrow diseases.

Credit: Tada Images / Shutterstock.com

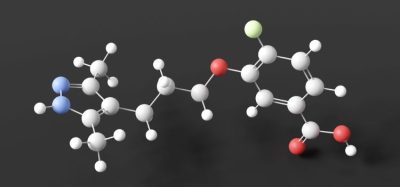

Merck has announced it will acquire biopharma Imago BioSciences, Inc for around $1.35 billion in total equity value, to facilitate development of Imago’s lead candidate bomedemstat (IMG-7289), an investigational oral lysine-specific demethylase 1 (LSD1) inhibitor for myeloproliferative neoplasms (MPNs).

”Robert M. Davis, President and Chief Executive Officer at Merck declared, “This acquisition of Imago strengthens our presence in the growing field of haematology.”

Lysine-specific demethylase 1 (LSD1)

“Evidence indicates that LSD1 (KDM1A) plays an important role in the maturation of blood cells in the bone marrow,” noted Dr Dean Y. Li, President of Merck Research Laboratories. “We look forward to working with the Imago team to further investigate the potential of bomedemstat for patients with myeloproliferative neoplasms.”

LSD1 is part of a group of epigenetic proteins that regulate gene expression through chemical modifications of proteins, RNA and DNA. LSD1 regulates the maturation of bone marrow stem cells and is essential for the differentiation of progenitor cells into mature megakaryocytes and granulocytes and production of blood cells. Targeting LSD1 for treating blood cancers offers a new mechanism for diseases associated with high morbidity and mortality.

Imago’s bomedemstat for treating myeloproliferative neoplasms

Imago develops new treatments for myeloproliferative neoplasms and other bone marrow diseases. Bomedemstat is currently being evaluated in Phase II clinical trials for essential thrombocythemia (ET), myelofibrosis (MF), polycythemia vera (PV) and other indications.

Dr Hugh Y. Rienhoff, Jr., Founder and Chief Executive Officer at Imago stated: “This agreement leverages Merck’s expertise to maximise the therapeutic potential of bomedemstat.

Merck’s acquisition of Imago

Under the terms of the agreement, through a subsidiary, Merck will initiate a tender offer to acquire all outstanding shares of Imago. The closing of the offer is subject to conditions such as the tender of shares representing at least a majority of the total of Imago’s outstanding shares, expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary conditions.

Upon the successful completion of a tender offer, Merck’s acquisition subsidiary will be merged into Imago. Any remaining shares of Imago’s common stock will be converted into the right to receive the same $36 per share price payable in the tender offer.

The companies expect the transaction to close in the first quarter of 2023.

Related topics

Big Pharma, Biopharmaceuticals, business news, Clinical Development, Drug Development, Industry Insight, Mergers & Acquisitions, Therapeutics