T-cell engagers set to drive immuno-oncology market

Posted: 11 August 2025 | Catherine Eckford (European Pharmaceutical Review) | No comments yet

Amid intensifying market competition, the next-generation therapies could shape the future of oncology.

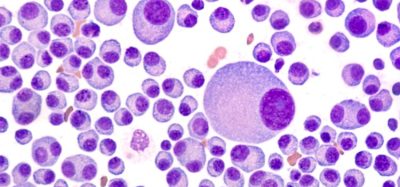

Immune checkpoint proteins expressed on T cells

Next-generation immuno-oncology products like bispecific T-cell engagers are poised to drive the next wave of market expansion as many established immune checkpoint inhibitors approach the patent cliff.

That’s according to new research by GlobalData, which also highlights the growth of the immuno-oncology market in the ten years to 2024 from $10.4 billion to $74 billion, fuelled by the success of immune checkpoint inhibitors and CAR-T cell therapies.

The analysts also said multi-specific antibodies would have strong market potential according, noting that eight out of the ten bispecific T-cell engagers currently approved on a global basis target haematologic cancers.

Bispecific T-cell engagers are expected to hold a 35 percent market share by 2031, while immune checkpoint inhibitors will decline from 77 percent to 43 percent of the projected $186 billion market between 2024 and 2031, according to GlobalData.

Overall, there are over 900 agents in clinical development across the eight major markets, including the US, the EU4+UK bloc, as well as Japan and China.

CAR-T cell therapies dominate the largest segment (cell therapy), with over 300 agents currently in development. This is followed by checkpoint modulators, of which around 160 agents are in clinical development.

Last year marked a significant period for approvals in the immuno-oncology sector. In February, Iovance Biotherapeutics’ Amtagvi was the first approved tumour-infiltrating lymphocyte (TIL) therapy for melanoma. In August, Adaptimmune’s Tecelra became the first FDA-approved T-cell receptor therapy for synovial sarcoma.

Gaining a competitive edge

Israel Stern, MSc, Oncology and Hematology Analyst at GlobalData, said: “The greatest investment is concentrated in therapeutic classes with proven efficacy, namely cell therapies and [T-cell engagers]. The immune checkpoint inhibitor landscape, while still growing, is becoming increasingly saturated.

“There is intense competition facing pipeline cell therapies entering the blood cancer space, especially in B-cell malignancies, with several CAR-T therapies on the market. To gain an edge, next-generation therapies such as CRISPR Therapeutics’ CTX-112, an allogeneic off-the-shelf CAR-T with shortened manufacturing time, may present a more scalable and accessible solution.”

New entrants to the market would “need to target novel immune checkpoints that either improve response rates or offer treatment options for patients previously exposed to checkpoint inhibitors”, Sterm added.