Pharmacovigilance and drug safety outsourcing worth $207.7M by 2024

Posted: 24 October 2018 | European Pharmaceutical Review | No comments yet

Outsourcing has become more popular with pharmaceutical companies, and has led to work being completed quicker, with less effort and cost involved…

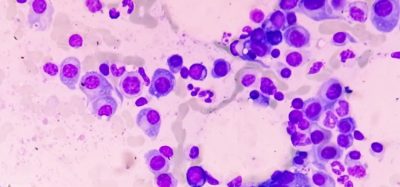

The global pharmacovigilance and drug safety software market size is expected to reach USD 207.7 million by 2024, according to a report by Grand View Research, presenting a CAGR of 6.5% during the forecast period. Increasing numbers of adverse drug reactions (ADR) is a key factor for market growth. ADR imposes a significant burden on research organisations and companies. To curb this problem, pharmaceutical companies are opting for contract outsourcing of these services.

Manufacturers are now striving to identify various ways of cost reduction and minimizing operational expenses by gradually shifting from being fully integrated pharmaceutical companies to sharing costs by collaborating with service providers. Outsourcing helps to increase internal resource flexibility, improves timelines, and results in better outcomes in short term, as well as long term. Outsourcing also helps achieve better pharmacovigilance through regulatory compliance, higher quality, better productivity, and improved strategic outcomes.

Pharmacovigilance service providers, in an attempt to ensure sustainability, are providing customised and end-to-end solutions to meet consumer needs. These firms are also incorporating integrated technologies such as electronic data capture and hosting of pharmacovigilance warehousing for aggregating cross-industry data for benefit-risk evaluation. Furthermore, the fact that service providers are now operating via a flexible and variable pricing structure and achieving operational excellence through constant product updates is expected to boost usage rates over the forecast period.

Further key findings from the report suggest:

- By functionality, fully integrated software solutions for pharmacovigilance are anticipated to reach USD 25.35 million by 2024, at a CAGR of 7.0 percent from 2016 to 2024. The ADR reporting software segment, on the other hand, is projected to ascend at a CAGR of 6.4 percent over the forecast period

- Based on delivery mode, the on-demand segment dominated the global pharmacovigilance software market with a share of over 52.0 percent in 2015

- On the basis of end use, the CROs and BPO segments are slated to witness lucrative growth owing to increasing adoption by outsourcing companies to curb healthcare costs

- The U.S. PV software market is anticipated to exceed USD 6.45 million by 2024. Asian countries, especially India and China, are also expected to observe remarkable growth in the coming years

- The market is relatively competitive in nature thanks to the presence of global multinational players. It is also consolidated to a certain extent

- Some of the key companies in the market are United BioSource Corporation; Sparta Systems, Inc.; Oracle Corporation; Ennov Solutions Inc.; Max Application; EXTEDO GmbH; AB Cube; Relsys; Online Business Applications, Inc.; and ArisGlobal.

The report segmented the global pharmacovigilance and drug safety software market on the basis of functionality, delivery mode, end use, and region:

- Pharmacovigilance and Drug Safety Software Functionality Outlook

- ADR Reporting

- Drug Safety Audits

- Issue Tracking

- Fully Integrated Software

- Pharmacovigilance and Drug Safety Software Delivery Mode Outlook

- On-Premise

- On-Demand

- Pharmacovigilance and Drug Safety Software End-use Outlook

- Pharma & biotech companies

- CROs

- BPOs

- Others

- Pharmacovigilance and Drug Safety Software Regional Outlook

- North America (including the US and Canada)

- Europe (including the UK and Germany)

- Asia Pacific (including Japan, China and India)

- Latin America (Mexicao and Brazil)

- Middle East & Africa (including South Africa)