Divest to invest: the new normal in biopharma?

Posted: 24 August 2023 | European Pharmaceutical Review, Subin Baral (Ernst & Young LLP) | No comments yet

Subin Baral, EY Global Deals Leader for Life Sciences, a partner at Ernst & Young LLP, shares exclusive insight on how strategies such as specialisation can help life science companies secure future growth and the key role divestments and spin-outs have on ensuring this strategic focus.

[life science] companies… need strategies to help adapt and secure future growth beyond the wave of biopharmaceutical patent expiries that will continue to roll over the industry until the end of the decade”

Analysis by Ernst & Young LLP has predicted that divestment will play a critical role not only in terms of portfolio prioritisation, but also as a source of alternate funding to invest in the priority areas within life sciences.

Subin Baral, EY Global Deals Leader for Life Sciences at Ernst & Young LLP told EPR that companies in the sector need strategies to help adapt and secure future growth beyond the wave of biopharmaceutical patent expiries that will continue to roll over the industry until the end of the decade. Mergers and acquisitions (M&A) will play a critical role in how companies adapt and as a result portfolio prioritisation is front and centre of the capital allocation strategies, he explained.

Securing future growth for life sciences

Baral continued, highlighting that research from EY has shown dealmaking is being complemented by an increased focus on divestments and spin-offs as companies restructure themselves around the core value offerings that will drive their future growth.

This strategy shift did not occur overnight, but evolved in response to the changing biopharma landscape. According to Baral, two main factors are changing the way life sciences companies think about dealmaking. First, macroeconomic factors like deglobalisation and inflation have increased the cost of capital, creating a need for more streamlined operations.

heightened focus from regulators is shifting the type of deals pharmaceutical companies are willing to execute”

Second, the regulatory environment, particularly in the US, is intensifying as new regulations like the Inflation Reduction Act put pressures on drug pricing and increased antitrust scrutiny from the US Federal Trade Commission and the UK Financial Conduct Authority. This heightened focus from regulators is shifting the type of deals pharmaceutical companies are willing to execute, Baral noted.

With these changes in mind, Baral emphasised three main upcoming challenges life sciences companies need to address to ensure their future performance:

- Securing access to new innovations that will fuel growth, including offsetting revenues lost to the patent cliff

- Emphasising capital efficiency and more streamlined business models fit for a more challenging global operating environment

- Responding to rapidly evolving new technologies and increased patient demand for better, more personalised health care experiences.

Securing access to innovation

The first of these priorities, securing access to innovation, is dependent on a strong M&A strategy, stated Baral. Most company pipelines are not deep enough to replace revenue erosion and many high-potential assets represent technology platforms, including mRNA, cell and gene therapy and next-generation antibodies. Even among the leaders of the biopharma sector, few companies have a significant presence across these platforms, Baral highlighted.

Nevertheless, M&A in life sciences has been “lukewarm” in 2023 to date, he acknowledged. While deal value has increased significantly in the last six months, deal volume is a better indicator of robustness of deal environment. EY’s analysis showed that only 54 deals of over $100 million were completed in the first six months. This is compared to 64 in January to June of 2022 and 85 in the same period of 2021, despite high value Big Pharma deals in the past six months.

Venture funding in 2022 came in at about $13.7 billion, down from the high of 2021. Yet it is significantly higher than the amount of capital raised annually over the previous decade. However, 22 percent of the total came from the proposed commitment of $3 billion first-round investment in the US biotech firm Altos Labs.

This represented the largest ever venture round in the history of the industry. The figure is 2.5 times greater than US biotech GRAIL’s record $1.2 billion round in 2017 and higher than the next 15 top venture funding rounds of 2022 combined.

Though the total of 567 venture rounds was down compared with 2021, it was nonetheless well above the whole-decade average of 472, as was the average size ($24.1 million compared with $17.4 million over the past decade). Looking ahead, Baral anticipated more substantial M&A activity as companies seek to close growth gaps.

Impact of divestments and spin-out on pharma

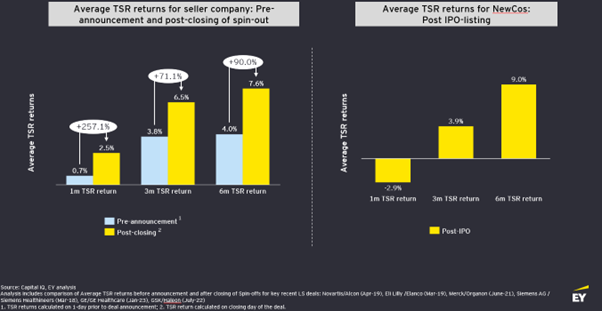

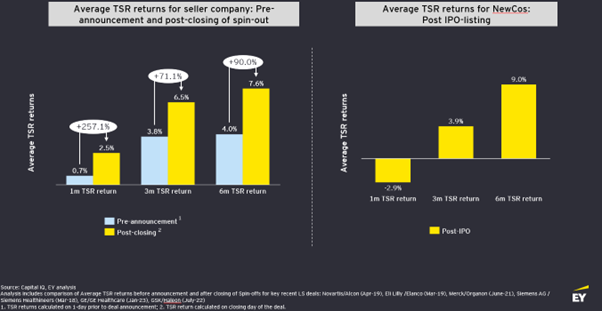

In the meantime, companies are moving to address the other key growth priorities: slimming down to increase efficiency and ability to respond quickly to a shifting health care market. Divestments and spin-outs are a key part of this evolution, according to Baral. Shedding non-core businesses has always been a key life sciences strategy. The analyses indicated that serial divestors create value for both the remaining company and the new company.

Forty-eight percent of CEOs indicated that they will divest, spin, or IPO a business in the next 12 months, according to the EY CEO Outlook Pulse Survey from March 2023.

There have been some major divestments/spin-offs within the life science sector in recent years, which Baral considered will continue in 2023.

Deals in the past year include:

- In the second half of this year, Novartis is expected to divest its Sandoz generics unit, following the example set by Sanofi’s Zentiva, and Pfizer’s Upjohn

- In May 2023, Johnson & Johnson spun out its consumer health unit as Kenvue

- GlaxoSmithKline and Pfizer divested a joint venture consumer health business to form Haleon in July 2022, listed as a new public entity with both companies retaining a stake

- Sanofi dropped its specialist API business in May 2022.

In terms of divestments and spin-outs, EY analysis showed that companies with a greater therapeutic area focus had greater return on capital over five years, compared to companies with greater diversification.

[EY analysis showed] companies with a greater therapeutic area focus had greater return on capital over five years, compared to companies with greater diversification”

Between 2000 to 2009, the predominant pharmaceutical company strategy was the creation of large portfolios spanning multiple categories through mega-mergers. These mega deals created behemoth companies that needed to spread capital too thin and included redundancies due to unrealised synergies.

Baral stated, that now, pharma instead predominantly divest non-core businesses like consumer health, medical devices, animal health, and even therapeutic areas that no longer align with strategic goals.

Life sciences investment strategy success

Cutting out peripheral activities and leaning into core strengths is an increasingly necessary move for companies seeking to succeed in any life sciences sector. No single company can master all these business models in an increasingly sophisticated market, Baral declared.

As new modalities take centre stage, life sciences innovators seeking to lead in these emerging fields will need a significant depth of scientific expertise along with considerable manufacturing and supply chain specialisation, and the associated capital costs, as well as deeper regulatory expertise. The commitments required by these new areas of innovation represent one more pressure on the industry to place bets and not try to disperse the effort across too many fields simultaneously.

In short, to secure growth in the future, companies will need to retool their business models for greater depth of specialisation rather than breadth of portfolio assets. Divestments and spinouts will continue to be a key part of ensuring this strategic focus and companies will need to ensure they get their divestment strategy right.

About the contributor

Subin has extensive global experience serving as a sell-side transaction advisor for Fortune 500 companies, including corporate and private equity. His experience includes working with companies in the pharmaceutical, medical device and biotechnology subsectors. He frequently speaks at life sciences events on acquisitions and divestitures topics.

He received his Master of Commerce from Macquarie University, Sydney, Australia. He is a chartered accountant from the Institute of Chartered Accountants of Australia and New Zealand.

Related topics

Big Pharma, Biopharmaceuticals, Data Analysis, Drug Development, Drug Markets, Industry Insight, Mergers & Acquisitions, Regulation & Legislation, Research & Development (R&D), Therapeutics